Question: TRUE/FALSE 1. When control is obtained through a stock acquisition, combined financial statements automatically result for future periods. 2. Tax loss carryovers are generally transferable

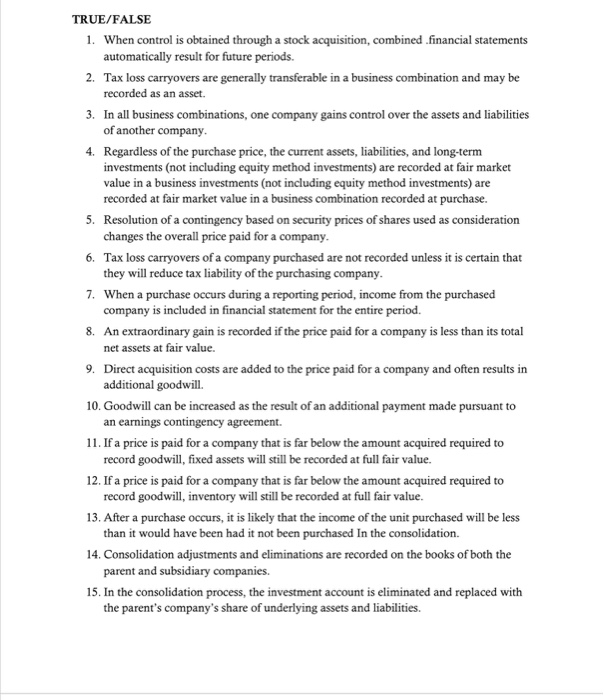

TRUE/FALSE 1. When control is obtained through a stock acquisition, combined financial statements automatically result for future periods. 2. Tax loss carryovers are generally transferable in a business combination and may be recorded as an asset. 3. In all business combinations, one company gains control over the assets and liabilities of another company. 4. Regardless of the purchase price, the current assets, liabilities, and long-term investments (not including equity method investments) are recorded at fair market value in a business investments (not including equity method investments) are recorded at fair market value in a business combination recorded at purchase. 5. Resolution of a contingency based on security prices of shares used as consideration changes the overall price paid for a company. 6. Tax loss carryovers of a company purchased are not recorded unless it is certain that they will reduce tax liability of the purchasing company. 7. When a purchase occurs during a reporting period, income from the purchased company is included in financial statement for the entire period. 8. An extraordinary gain is recorded if the price paid for a company is less than its total net assets at fair value. 9. Direct acquisition costs are added to the price paid for a company and often results in additional goodwill. 10. Goodwill can be increased as the result of an additional payment made pursuant to an earnings contingency agreement. 11. If a price is paid for a company that is far below the amount acquired required to record goodwill, fixed assets will still be recorded at full fair value. 12. If a price is paid for a company that is far below the amount acquired required to record goodwill, inventory will still be recorded at full fair value. 13. After a purchase occurs, it is likely that the income of the unit purchased will be less than it would have been had it not been purchased in the consolidation. 14. Consolidation adjustments and eliminations are recorded on the books of both the parent and subsidiary companies. 15. In the consolidation process, the investment account is eliminated and replaced with the parent's company's share of underlying assets and liabilities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts