Question: True/False (6 points, 0.5 point each) 1. When a petty cash fund is established, the entry contains a credit to Cash. 2. When a petty

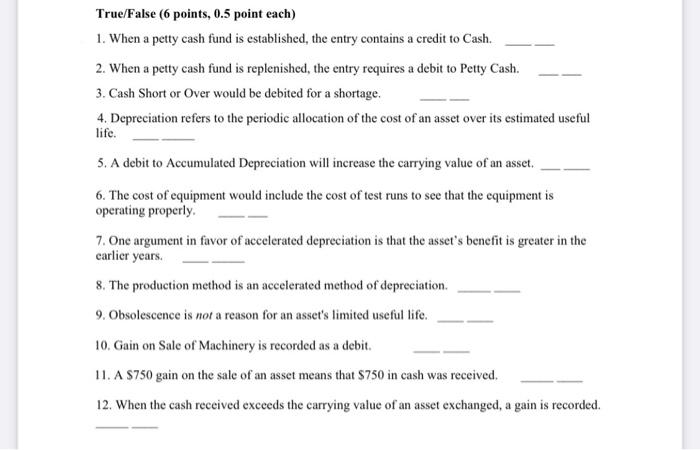

True/False (6 points, 0.5 point each) 1. When a petty cash fund is established, the entry contains a credit to Cash. 2. When a petty cash fund is replenished, the entry requires a debit to Petty Cash. 3. Cash Short or Over would be debited for a shortage. 4. Depreciation refers to the periodic allocation of the cost of an asset over its estimated useful life. 5. A debit to Accumulated Depreciation will increase the carrying value of an asset. 6. The cost of equipment would include the cost of test runs to see that the equipment is operating properly. 7. Onc argument in favor of accelerated depreciation is that the asset's benefit is greater in the carlier years. 8. The production method is an accelerated method of depreciation. 9. Obsolescence is not a reason for an asset's limited useful life. 10. Gain on Sale of Machinery is recorded as a debit. 11. A $750 gain on the sale of an asset means that $750 in cash was received 12. When the cash received exceeds the carrying value of an asset exchanged, a gain is recorded

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts