Question: True/False: a. An investor will require a higher expected return from XYZ than ABC to compensate for the greater risk. [ Select ] [True, False]

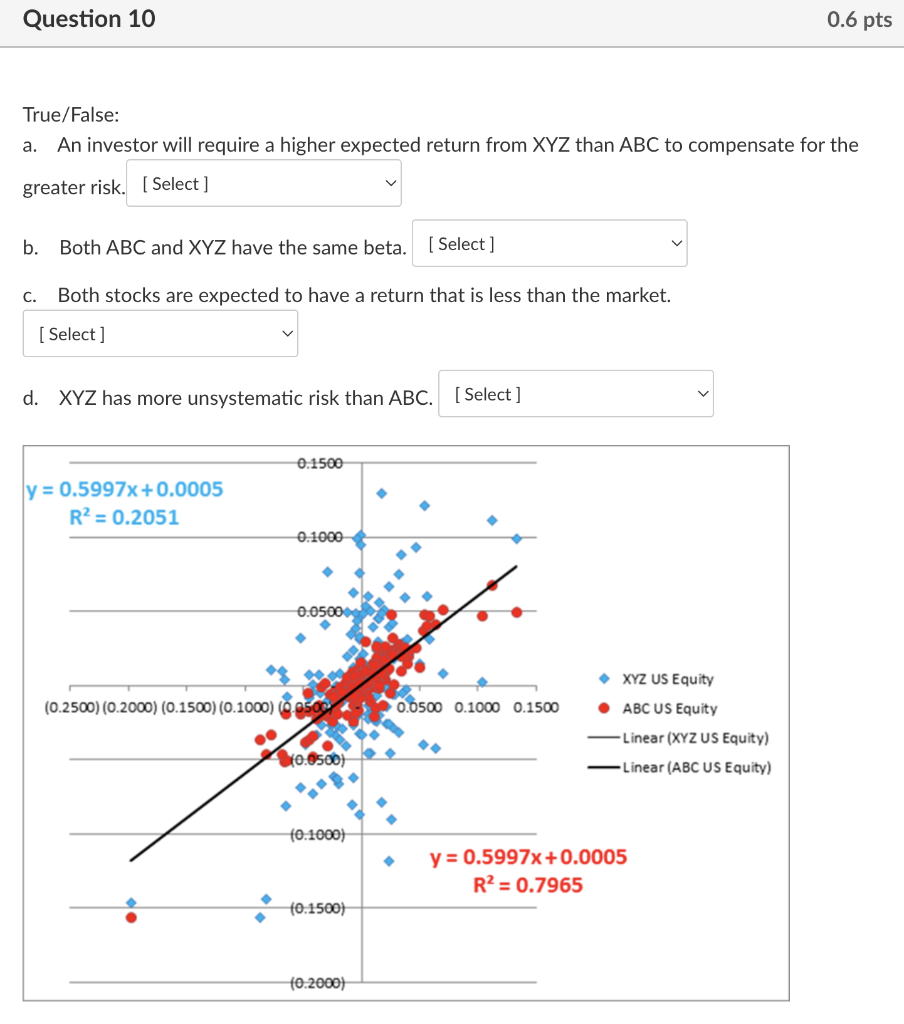

True/False: a. An investor will require a higher expected return from XYZ than ABC to compensate for the greater risk. [ Select ] ["True", "False"] b. Both ABC and XYZ have the same beta. [ Select ] ["True", "False"] c. Both stocks are expected to have a return that is less than the market. [ Select ] ["True", "False"] d. XYZ has more unsystematic risk than ABC. [ Select ] ["True", "False"]

Question 10 0.6 pts True/False: An investor will require a higher expected return from XYZ than ABC to compensate for the a. greater risk. (Select ] b. Both ABC and XYZ have the same beta. [ Select] C. Both stocks are expected to have a return that is less than the market. [Select] d. XYZ has more unsystematic risk than ABC. [Select ] 0.1500 ly = 0.5997x+0.0005 R2 = 0.2051 0.1000 0.0500 XYZ US Equity (0.2500) (0.2000) (0.1500) (0.1000) (sor 0.0500 0.1000 0.1500 ABC US Equity 10.0500) - Linear (XYZ US Equity) -Linear (ABC US Equity) 10.1000) y = 0.5997x +0.0005 R2 = 0.7965 10.1500) 10.2000)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts