Question: True/False Indicate whether the sentence or statement is true or false. 1. When a note is received from a customer on account, it is recorded

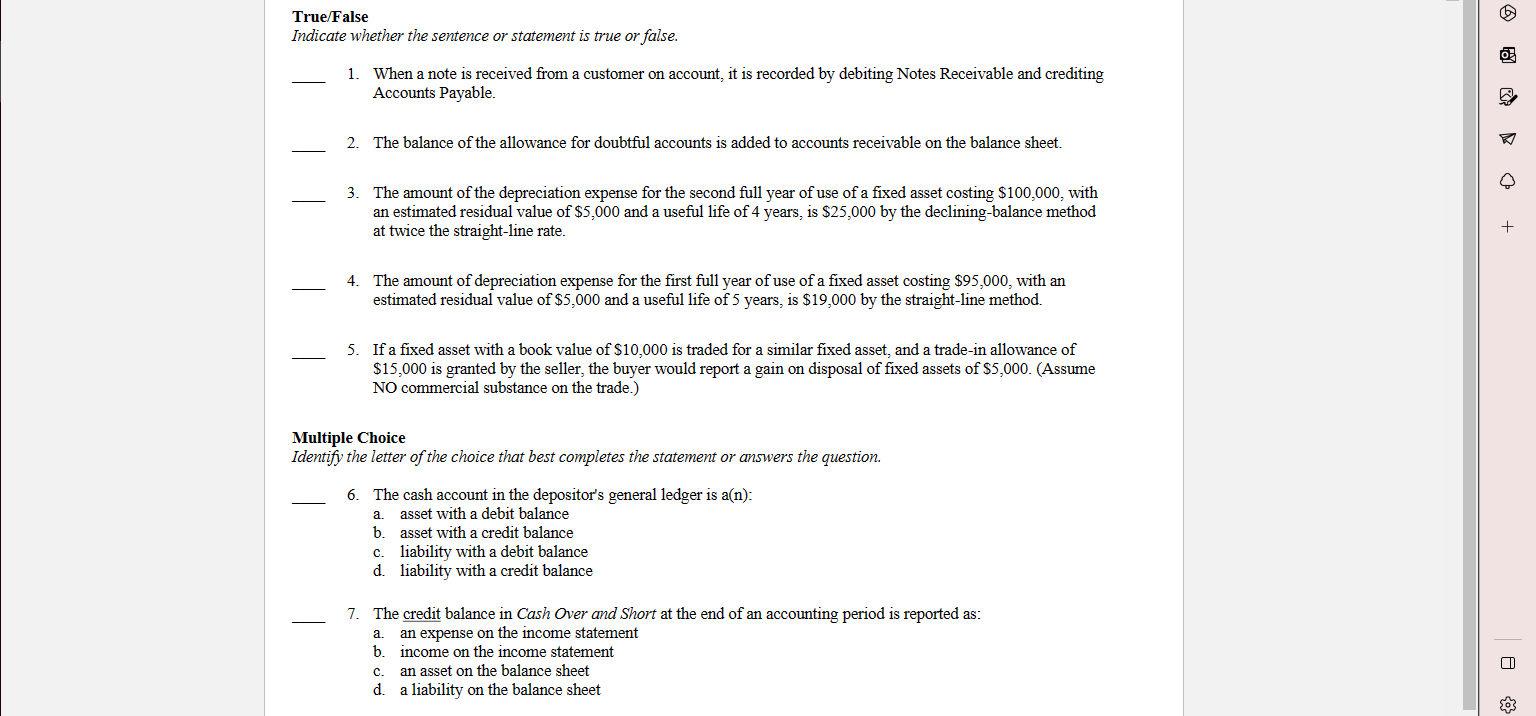

True/False Indicate whether the sentence or statement is true or false. 1. When a note is received from a customer on account, it is recorded by debiting Notes Receivable and crediting Accounts Payable. 2. The balance of the allowance for doubtful accounts is added to accounts receivable on the balance sheet. 3. The amount of the depreciation expense for the second full year of use of a fixed asset costing $100,000, with an estimated residual value of $5,000 and a useful life of 4 years, is $25,000 by the declining-balance method at twice the straight-line rate. 4. The amount of depreciation expense for the first full year of use of a fixed asset costing $95,000, with an estimated residual value of $5,000 and a useful life of 5 years, is $19,000 by the straight-line method. 5. If a fixed asset with a book value of $10,000 is traded for a similar fixed asset, and a trade-in allowance of $15,000 is granted by the seller, the buyer would report a gain on disposal of fixed assets of $5,000. (Assume NO commercial substance on the trade.) Multiple Choice Identify the letter of the choice that best completes the statement or answers the question. 6. The cash account in the depositor's general ledger is a(n): a. asset with a debit balance b. asset with a credit balance c. liability with a debit balance d. liability with a credit balance 7. The credit balance in Cash Over and Short at the end of an accounting period is reported as: a. an expense on the income statement b. income on the income statement c. an asset on the balance sheet d. a liability on the balance sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts