Question: True/False Indicate whether the statement is true or false. 1. A bond has a $1,000 par value, makes annual interest paymen called, and is not

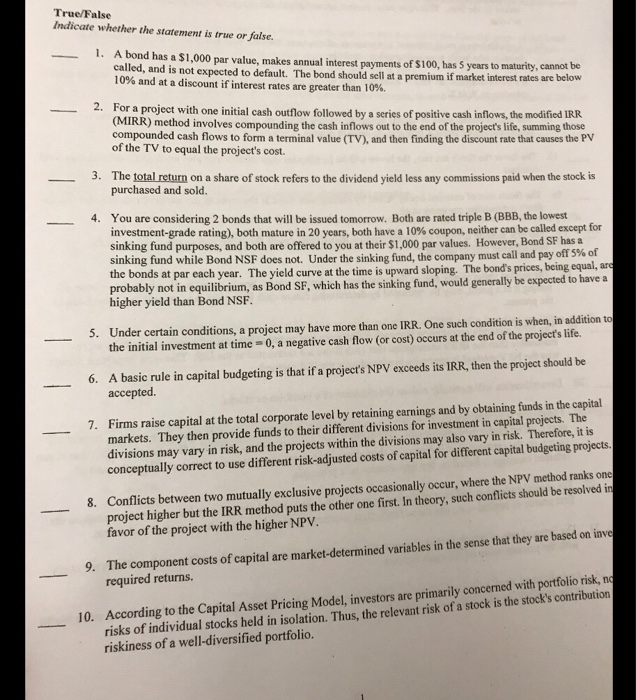

True/False Indicate whether the statement is true or false. 1. A bond has a $1,000 par value, makes annual interest paymen called, and is not expected to default. The bond should sell at a premium if market interest rates are bre ts of $100, has 5 years to maturity, cannot be 10% and at a discount if interest rates are greater than 10%, 2. For a project with one initial cash outflow followed by a series of positive cash inflows, the modified IRR (MIRR) method involves compounding the cash inflows out to the end of the project's life, summing those compounded cash flows to form a terminal value (TV), and then finding the discount rate that causes the PV of the TV to equal the project's cost 3. The total return on a share of stock refers to the dividend yield less any commissions paid when the stock is purchased and sold. 4. You are considering 2 bonds that will be issued tomorrow. Both are rated triple B (BBB, the lowest investment-grade rating), both mature in 20 years, both have a 10% coupon, neither can be called exceptfor sinking fund purposes, and both are offered to you at their $1,000 par values. However, Bond SF hasa sinking fund while Bond NSF does not. Under the sinking fund, the company must call and pay off 5% of the bonds at par each year. The yield curve at the time is upward sloping. The bond's prices, being equal, ar probably not in equilibrium, as Bond SF, which has the sinking fund, would generally be expected to have a higher yield than Bond NSF. 5. Under certain conditions, a project may have more than one IRR. One such condition is when, in addition to 6. A basic rule in capital budgeting is that if a project's NPV exceeds its IRR, then the project should be 7. Firms raise capital at the total corporate level by retaining earnings and by obtaining funds in the capital the initial investment at time 0, a negative cash flow (or cost) occurs at the end of the projets life. accepted. markets. They then provide funds to their different divisions for investment in capital projects. The divisions may vary in risk, and the projects within the divisions may also vary in risk. Therefore, it is conceptually correct to use different risk-adjusted costs of capital for different capital budgeting projects Conflicts between two mutually exclusive projects occasionally occur, where the NPV method ranks cn project higher but the IRR method puts the other one first. In theory, such conflicts should be resolved in favor of the project with the higher NPV 8. he component costs of capital are market-determined variables in the sense that they are based on inve required returns. 9. T risks of individual stocks held in isolation. Thus, the relevant risk of a stock is the stock's contribution riskiness of a well-diversified portfolio 10. According to the Capital Asset Pricing Model, investors are primarily concerned with portfolio risk, n

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts