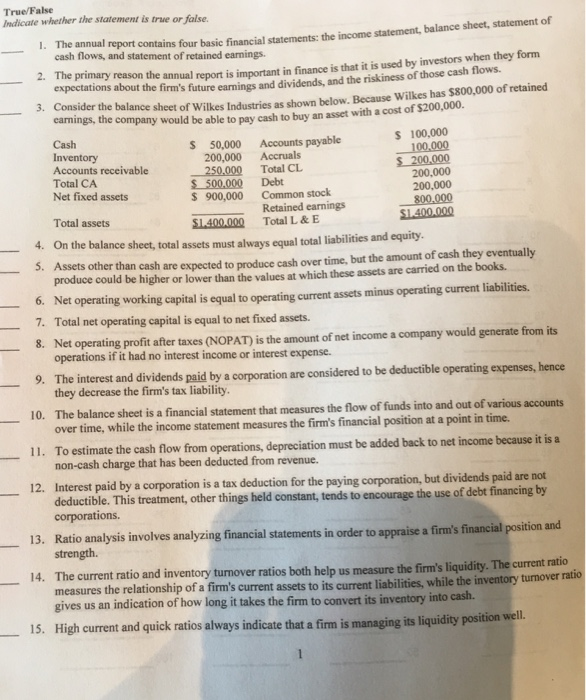

Question: True/False Indicate whether the statement is true or false. sheet, statement of I. The annual report contains four basic financial statements: the income statement, balance

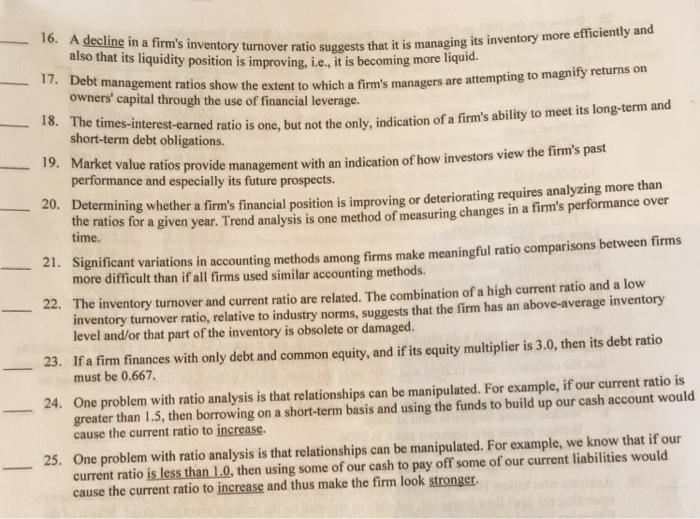

True/False Indicate whether the statement is true or false. sheet, statement of I. The annual report contains four basic financial statements: the income statement, balance s cash flows, and statement of retained earnings expectations about the firm's future earnings and dividends, and the riskiness of those cash tlows. 3. Consider the balance sheet of Wilkes Industries as shown below. Because Wilkes has $800,000 of retained earnings, the company would be able to pay cash to buy an asset with a cost of $200,000. Cash Inventory Accounts receivable Total CA Net fixed assets S 100,000 S 50,000 Accounts payable 200,000 Accruals 100.000 S 200,000 200,000 250,000 Total CL S 500,000 Debt $ 900,000 Common stock 200,000 Retained earnings Total assets S400.000 Total L&E 1.400,000 n the balance sheet, total assets must always equal total liabilities and equity. Assets other than cash are expected to produce cash over time, but the amount of cash they eventually produce could be higher or lower than the values at which these assets are carried on the books. 6. Net operating working capital is equal to operating current assets minus operating current liabilities 7. Total net operating capital is equal to net fixed assets. 8. Net operating profit after taxes (NOPAT) is the amount of net income a company would generate from its operations if it had no interest income or interest expense 9. The interest and dividends paid by a corporation are considered to be deductible operating expenses, hence they decrease the firm's tax liability. The balance sheet is a financial statement that measures the flow of funds into and out of various accounts over time, while the income statement measures the firm's financial position at a point in time. 10. To estimate the cash flow from operations, depreciation must be added back to net income because it is a non-cash charge that has been deducted from revenue. 11. 12. Interest paid by a corporation is a tax deduction for the paying corporation, but dividends paid are not deductible. This treatment, other things held constant, tends to encourage the use of corporations 13. Ratio analysis involves analyzing financial statements in order to appraise a firm's financial position and strength. The current ratio and inventory tunover ratios both help us measure the firm's liquidity. The current ratio measures the relationship of a firm's current assets to its current liabilities, while the inventory turnover rati gives us an indication of how long it takes the firm to convert its inventory into cash. 14. 15. High current and quick ratios always indicate that a fim is managing its liquidity position 16. A decline in a firm's inventory turnover ratio suggests also that its liquidity position is improving, i.e., it is becoming more liquid. ory turnover ratio suggests that it is managing its inventory more efficiently and 17. Deb t management ratios show the extent to which a firm's managers are attempting to magnify returns on owners' capital through the use of financial leverage. short-term debt obligations. performance and especially its future prospects. 18. T es-interest-earned ratio is one, but not the only, indication of a firm's ability to meet its long-term and 19. Market val ue ratios provide management with an indication of how investors view the firm's past 20. Det ermining whether a firm's financial position is improving or deteriorating requires analyzing more than ratios for a given year. Trend analysis is one method of measuring changes in a firm's performance over time. Significant variations in accounting methods among firms make meaningful ratio comparisons between firms more difficult than if all firms used similar accounting methods 21. The inventory turnover and current ratio are related. The combination of a high current ratio and a low inventory turnover ratio, relative to industry norms, suggests that the firm has an above-average inventory level and/or that part of the inventory is obsolete or damaged. 22. 23. If a firm finances with only debt and common equity, and if its equity multiplier is 3.0, then its debt ratio must be 0.667 One problem with ratio analysis is that relationships can be manipulated. For example, if our current ratio is greater than 1.5, then borrowing on a short-term basis and using the funds to build up our cash account would cause the current ratio to increase. 24. One problem with ratio analysis is that relationships can be manipulated. For example, we know that if our current ratio is less than 1.0, then using some of our cash to pay off some of our current liabilities would cause the current ratio to increase and thus make the firm look stronger. 25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts