Question: True/False need 1-10 True False O 1. A bond's coupon is more likely to change than to remain the same over the bond's life. 2.

True/False need 1-10

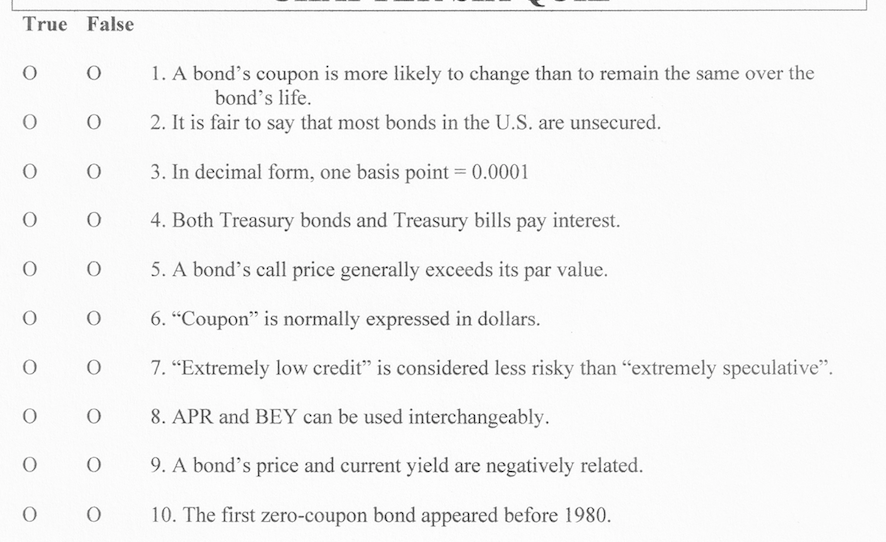

True False O 1. A bond's coupon is more likely to change than to remain the same over the bond's life. 2. It is fair to say that most bonds in the U.S. are unsecured. O 0 O O 3. In decimal form, one basis point = 0.0001 O 0 4. Both Treasury bonds and Treasury bills pay interest. O O 5. A bond's call price generally exceeds its value. 6. Coupon is normally expressed in dollars. O O 7. Extremely low credit is considered less risky than extremely speculative. O O 8. APR and BEY can be used interchangeably. O 9. A bond's price and current yield are negatively related. 0 O 10. The first zero-coupon bond appeared before 1980

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts