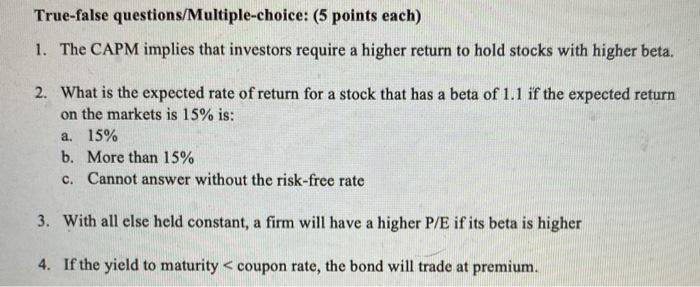

Question: True-false questions/ Multiple-choice: (5 points each) 1. The CAPM implies that investors require a higher return to hold stocks with higher beta. 2. What is

True-false questions/ Multiple-choice: (5 points each) 1. The CAPM implies that investors require a higher return to hold stocks with higher beta. 2. What is the expected rate of return for a stock that has a beta of 1.1 if the expected return on the markets is 15% is: a. 15% b. More than 15% c. Cannot answer without the risk-free rate 3. With all else held constant, a firm will have a higher P/E if its beta is higher 4. If the yield to maturity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts