Question: True/False Section: Question 1 (1 point) Corporations are required to pay federal income taxes. Question 2 (1 point) Businesses are granted charters under federal law.

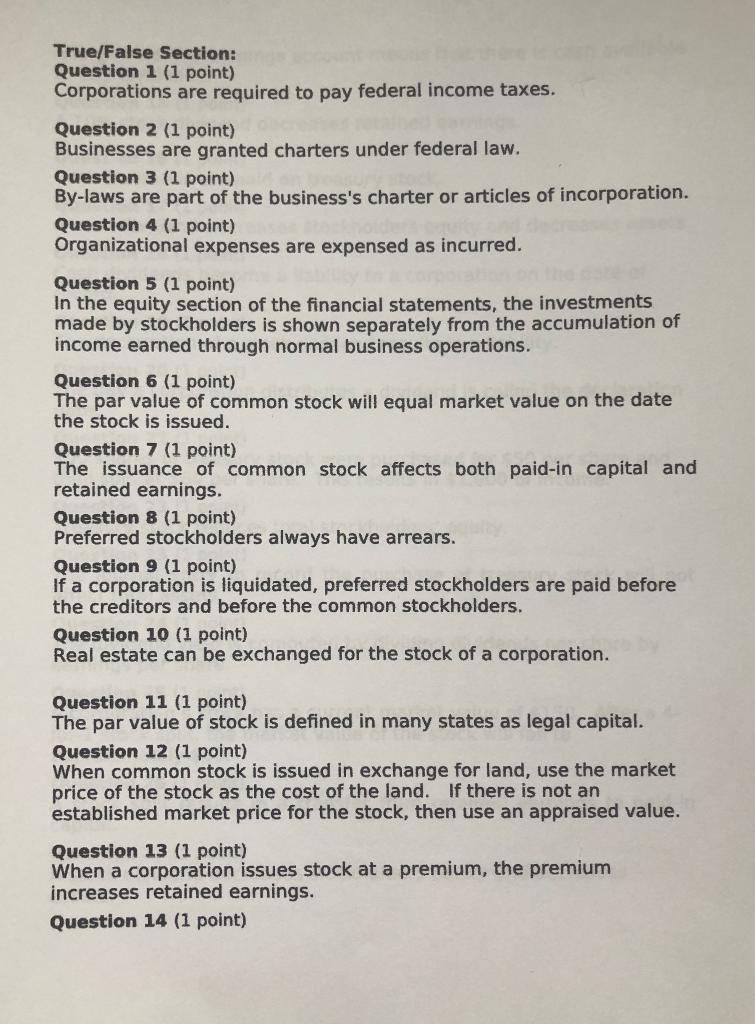

True/False Section: Question 1 (1 point) Corporations are required to pay federal income taxes. Question 2 (1 point) Businesses are granted charters under federal law. Question 3 (1 point) By-laws are part of the business's charter or articles of incorporation. Question 4 (1 point) Organizational expenses are expensed as incurred. Question 5 (1 point) In the equity section of the financial statements, the investments made by stockholders is shown separately from the accumulation of income earned through normal business operations. Question 6 (1 point) The par value of common stock will equal market value on the date the stock is issued. Question 7 (1 point) The issuance of common stock affects both paid-in capital and retained earnings. Question 8 (1 point) Preferred stockholders always have arrears. Question 9 (1 point) If a corporation is liquidated, preferred stockholders are paid before the creditors and before the common stockholders. Question 10 (1 point) Real estate can be exchanged for the stock of a corporation. Question 11 (1 point) The par value of stock is defined in many states as legal capital. Question 12 (1 point) When common stock is issued in exchange for land, use the market price of the stock as the cost of the land. If there is not an established market price for the stock, then use an appraised value. Question 13 (1 point) When a corporation issues stock at a premium, the premium increases retained earnings. Question 14 (1 point)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts