Question: True/False Statement. Indicate (T) for True and (F) for False for the following statements. 1. In Malaysia, the Self-Assessment System replaced the Official Assessment System.

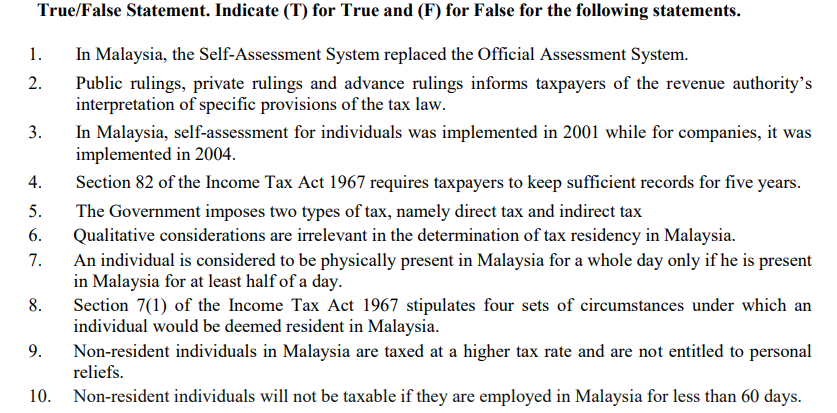

True/False Statement. Indicate (T) for True and (F) for False for the following statements. 1. In Malaysia, the Self-Assessment System replaced the Official Assessment System. 2. Public rulings, private rulings and advance rulings informs taxpayers of the revenue authority's interpretation of specific provisions of the tax law. 3. In Malaysia, self-assessment for individuals was implemented in 2001 while for companies, it was implemented in 2004. 4. Section 82 of the Income Tax Act 1967 requires taxpayers to keep sufficient records for five years. 5. The Government imposes two types of tax, namely direct tax and indirect tax 6. Qualitative considerations are irrelevant in the determination of tax residency in Malaysia. 7. An individual is considered to be physically present in Malaysia for a whole day only if he is present in Malaysia for at least half of a day. 8. Section 7(1) of the Income Tax Act 1967 stipulates four sets of circumstances under which an individual would be deemed resident in Malaysia. 9. Non-resident individuals in Malaysia are taxed at a higher tax rate and are not entitled to personal reliefs. 10. Non-resident individuals will not be taxable if they are employed in Malaysia for less than 60 days

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts