Question: TRUE/FALSE. Write T if the statement is true and F if the statement is false 21) AASB 116: Property, Plant and Equipment specifies that the

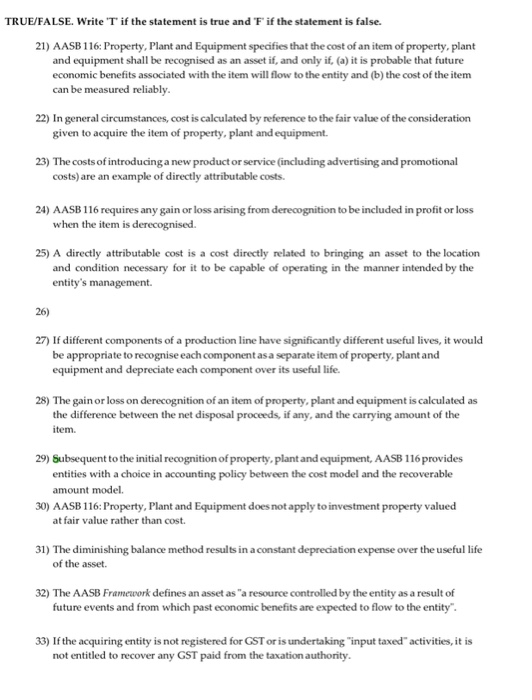

TRUE/FALSE. Write T if the statement is true and F if the statement is false 21) AASB 116: Property, Plant and Equipment specifies that the cost of an item of property, plant and equipment shall be recognised as an asset if, and only if, (a) it is probable that future economic benefits associated with the item will flow to the entity and (b) the cost of the item can be measured reliably 22) In general circumstances, cost is calculated by reference to the fair value of the consideration given to acquire the item of property, plant and equipment. 23) The costs of introducing a new product or service (including advertising and promotional costs) are an example of directly attributable costs. 24) AASB 116 requires any gain or loss arising from derecognition to be included in profit or loss when the item is derecognised 25) A directly attributable cost is a cost directly related to bringing an asset to the location and condition necessary for it to be capable of operating in the manner intended by the entity's management. 26) 27) If different components of a production line have significantly different useful lives, it would be appropriate to recognise each component as a separate item of property, plant and equipment and depreciate each component over its useful life. 28) The gain or loss on derecognition of an item of property, plant and equipment is calculated as the difference between the net disposal proceeds, if any, and the carrying amount of the item. 29) Subsequent to the initial recognition of property, plant and equipment, AASB 116 provides entities with a choice in accounting policy between the cost model and the recoverable amount model. 30) AASB 116: Property, Plant and Equipment does not apply to investment property valued at fair value rather than cost. 31) The diminishing balance method results in a constant depreciation expense over the useful life of the asset. 32) The AASB Framework defines an asset as "a resource controlled by the entity as a result of future events and from which past economic benefits are expected to flow to the entity 33) If the acquiring entity is not registered for GST or is undertaking "input taxed" activities, it is not entitled to recover any GST paid from the taxation authority

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts