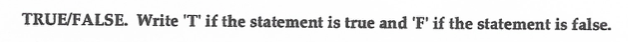

Question: TRUE/FALSE. Write 'T' if the statement is true and 'F' if the statement is false. 1) Taxpayers are entitled to a depletion deduction if they

TRUE/FALSE. Write 'T' if the statement is true and 'F' if the statement is false. 1) Taxpayers are entitled to a depletion deduction if they have an economic interest in the natural resource property 1) 2) If the business use of listed property is 50% or less of the total usage, the alternative depreciation system must be used. 2) 3) Under the MACRS system, depreciation rates for real property must always use the mid-month convention in the year of acquisition. 3) 4) With respect to options to accelerate depreciation deductions for new qualifying assets, a taxpayer must elect into Sec. 179 expensing, but elect out of bonus depreciation. 4) 5) The MACRS system requires that residential rental property and nonresidential real property be depreciated using the straight-line method. 5) 6) Under the MACRS system, the same convention that applies in the year of acquisition (e.g., half-year, mid-quarter, or mid-month) also applies in the year of disposition. 6) 7) If the business use of listed property decreases to 50% or less of the total usage, the property is subject to depreciation recapture. 7)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts