Question: TRUE/FALSE. Write T' if the statement is true and'F' if the statement is false. 1) A fiscal year refers to an organization's accounting period that

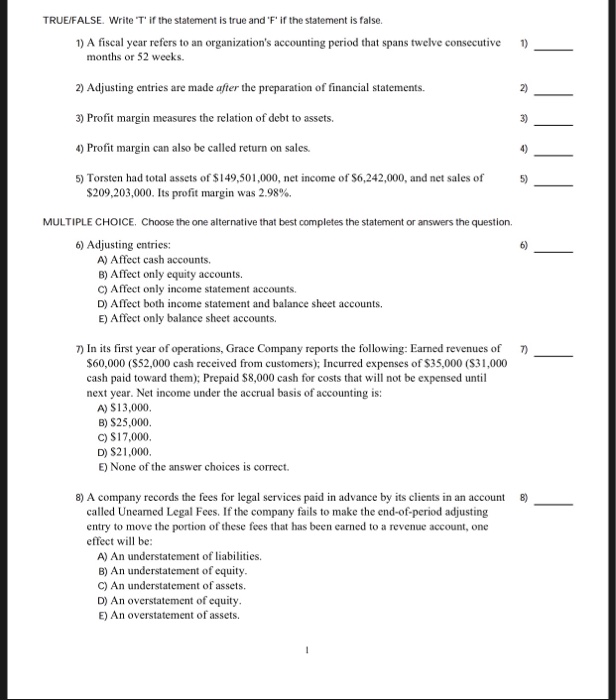

TRUE/FALSE. Write T' if the statement is true and'F' if the statement is false. 1) A fiscal year refers to an organization's accounting period that spans twelve consecutive 1) months or 52 weeks. 2) Adjusting entries are made after the preparation of financial statements. 3) Profit margin measures the relation of debt to assets. 4) Profit margin can also be called return on sales. 5) Torsten had total assets of S149,501,000, net income of S6,242,000, and net sales of 2) 3) 5) 209,203,000. Its profit margin was 2.98%. MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question. 6) Adjusting entries: A) Affect cash accounts B) Affect only equity accounts. C) Affect only income statement accounts, D) Affect both income statement and balance sheet accounts. E) Affect only balance sheet accounts. 7) In its first year of operations, Grace Company reports the following: Earned revenues of 60,000 (S52,000 cash received from customers); Incurred expenses of S35,000 (S31,000 cash paid toward them); Prepaid S8,000 cash for costs that will not be expensed until next year. Net income under the accrual basis of accounting is: A) S13,000 B) S25,000 C) S17,000. D) S21,000. E) None of the answer choices is correct. 8) A company records the fees for legal services paid in advance by its clients in an account 8) called Uncamed Legal Fees. If the company fails to make the end-of-period adjusting entry to move the portion of these fees that has been earned to a revenue account, one effect will be: A) An understatement of liabilities. B) An understatement of equity. C) An understatement of assets. D) An overstatement of equity E) An overstatement of assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts