Question: Truesdale Incorporated is considering a new project whose data are shown below. What is the project;s year one cash flow? Sales Revenue $21,750; Depreciation $8,000;

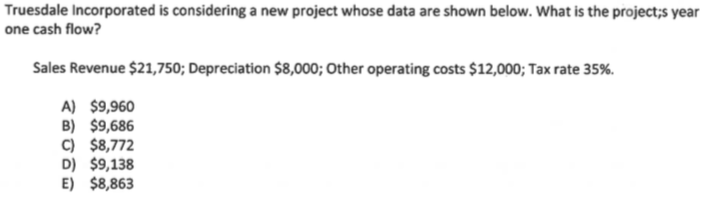

Truesdale Incorporated is considering a new project whose data are shown below. What is the project;s year one cash flow? Sales Revenue $21,750; Depreciation $8,000; Other operating costs $12,000; Tax rate 35%. A) $9,960 B) $9,686 C) $8,772 D) $9,138 E) $8,863

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts