Question: TRY FULL SWIN PRINTER VERSION NEXT Exercise 3-05 following information is available for the year ended December 31, 2021 Action Quest Games adjusts its accounts

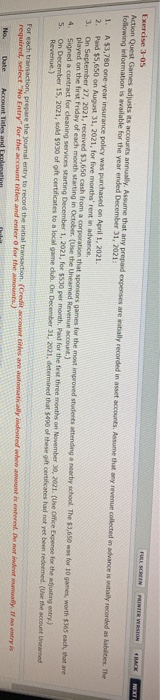

TRY FULL SWIN PRINTER VERSION NEXT Exercise 3-05 following information is available for the year ended December 31, 2021 Action Quest Games adjusts its accounts any. Assume that any prepaid expenses are wally recorded in an accounts. Assume that any revenue collected in advance is wally recorded as labies. The 1. A $3,780 one-year insurance policy was purchased on April 1, 2021. 2 Paid $5,650 on August 31, 2021, for five months' rent in advance On September 27, 2021, received $3,650 cash from a corporation that sponsors games for the most proved students attending arby school. The $3,650 was for 10 games, worth $365 each, that are played on the first Friday of each month starting in October (Use the neared Revenue account.) 4 Signed a contract for cleaning services starting December 1, 2021, for $5.00 per month Paid for the first three months on November 30, 2001. (Use Office penge for the adjusting entry) 5. On December 15, 2021, sold 5930 of gift certificates to a local game club on December 31, 2001. determined that of these certificates had not yet be redeemed (Use the account Unearned Revenue) For each transaction, prepare the journal entry to record the initial transaction. (Credit www.titles are automatically indeed wount is entered De not have way. It entry is required, select "No Entry" for the account titles and enter for the amounts.) No. Date Account Titles and

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts