Question: tThis is all the question asks. The question does not indicate what transactions are charged GST. XYZ Cleaning completed the following transactions during the month

tThis is all the question asks. The question does not indicate what transactions are charged GST.

tThis is all the question asks. The question does not indicate what transactions are charged GST.

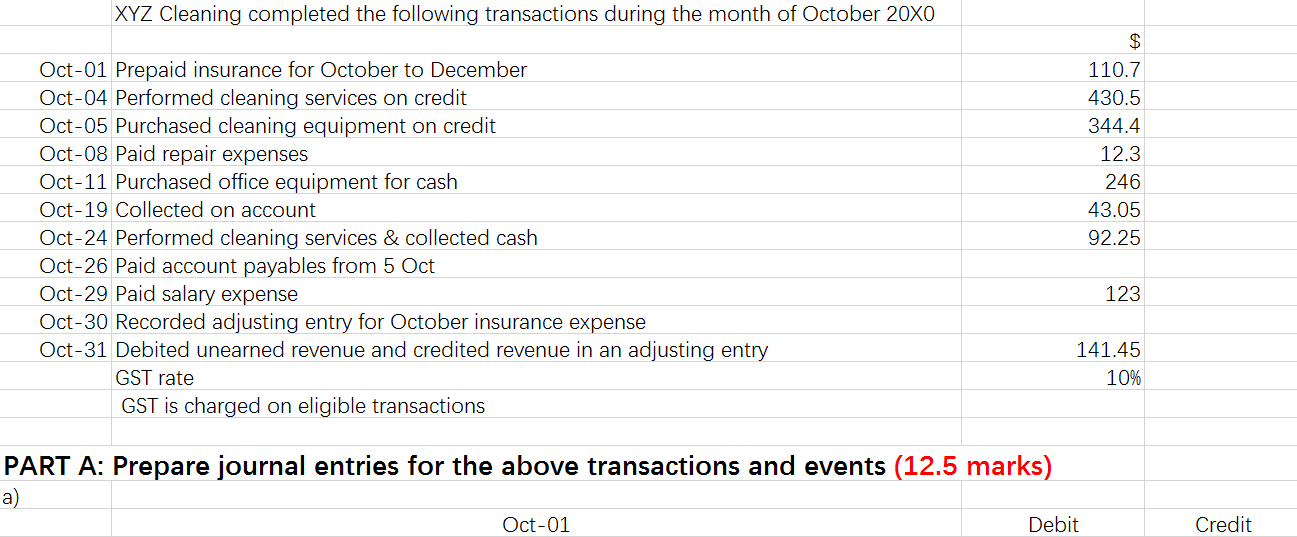

XYZ Cleaning completed the following transactions during the month of October 20X0 $ Oct-01 Prepaid insurance for October to December Oct-04 Performed cleaning services on credit Oct-05 Purchased cleaning equipment on credit Oct-08 Paid repair expenses Oct-11 Purchased office equipment for cash Oct-19 Collected on account Oct-24 Performed cleaning services & collected cash Oct-26 Paid account payables from 5 Oct Oct-29 Paid salary expense Oct-30 Recorded adjusting entry for October insurance expense Oct-31 Debited unearned revenue and credited revenue in an adjusting entry GST rate GST is charged on eligible transactions 110.7 430.5 344.4 12.3 246 43.05 92.25 123 141.45 10% PART A: Prepare journal entries for the above transactions and events (12.5 marks) a) Oct-01 Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts