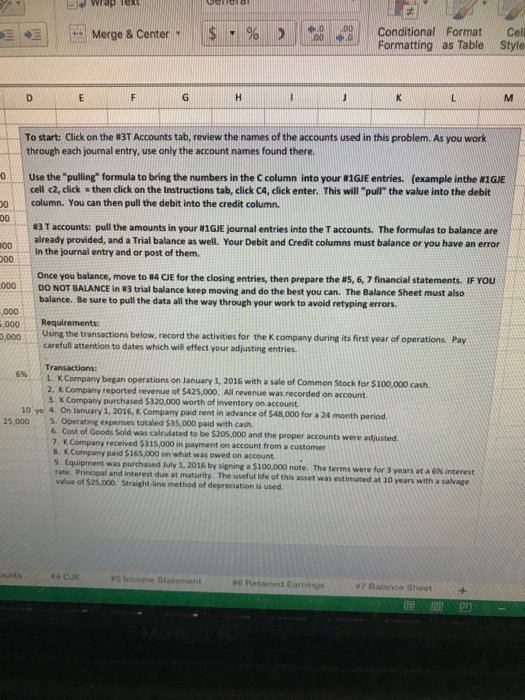

Question: :| | |tti Merge & Center- l $ . % , | | #0-0 Conditional Format Col Formatting as Table Style To start: Click on

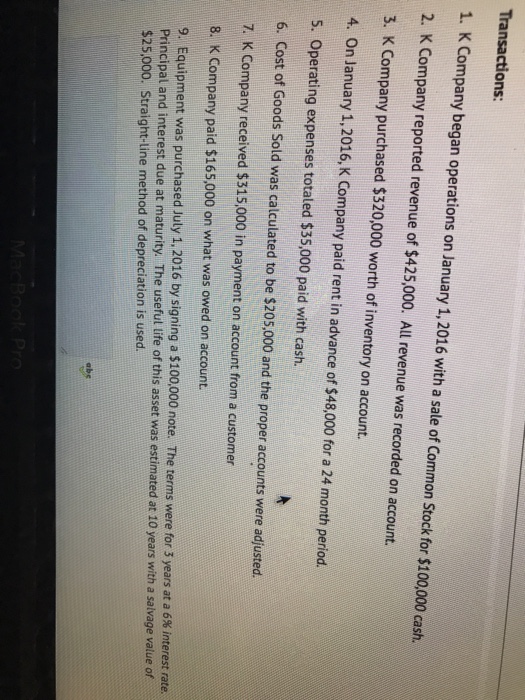

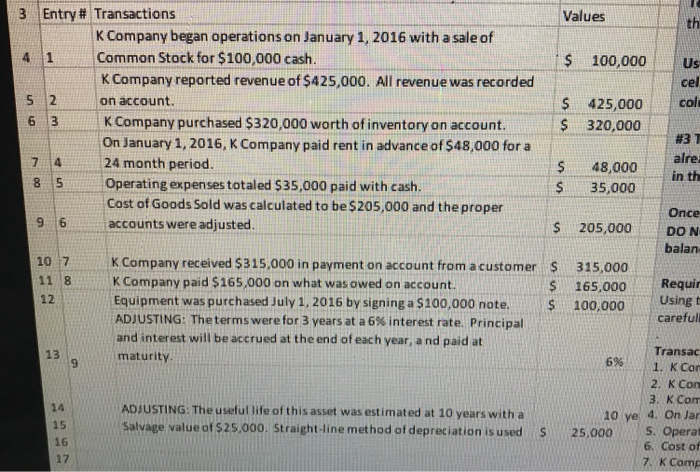

:| | |tti Merge & Center- l $ . % , | | #0-0 Conditional Format Col Formatting as Table Style To start: Click on the #3T Accounts tab, review the names of the accounts used in this problem. As you work through each journal entry, use only the account names found there. 0 : Use the "pulling" formula to bring the numbers in the C column into your #1 GE entries. (example inthe E1GE cell c2, click - then click on the Instructions tab, click CA, click enter. This will "pull the value into the debit 00 column. You can then pull the debit into the credit column. #3 T accounts: pull the amounts in your #1GJE journal entries into the T accounts. The formulas to balance are already provided, and a Trial balance as well. Your Debit and Credit columns must balance or you have an error in the journal entry and or post of them. Once you balance, move to #4 CE for the closing entries, then prepare the #5, 6, 7 financial statements. IF YOU 00DO NOT BALANCE in W3 trial balance keep moving and do the best you can. The Balance Sheet must also balance. Be sure to pull the data all the way through your work to avoid retyping errors. ,000 ,000 Requirements: ,000Using the transactions below, record the activities for the K company during its first year of operations. Pay carefull attention to dates which willeffect your adjusting entries 1. K Company began operations on January 1, 2016 with a sale of Common Stock for $100.000 cash 2. K Company reported revenue of $425,000. All revenue was recorded on account 3. K Company purchased $320,000 worth of inventory on account 10 ye 4. On lanuary 1, 2016, K Company paid rent in advance of $48,000 for a 24 month period 25,000 5. Operating expenses totaled $35,000 paid with cash Sold was calculated to be $205,000 and the proper accounts were adjusted 7. K Company received $315,000 in payment on account from a customer 8. K Company paid $165,000 on what was owed on account ent was purchased July 1, 2016 by signing a Sooooo note. The terms were for 3 years at a 6% interest rate. Principal and interest due at maturity. The useful life of this asset was estimated at 10 years with a salvage value of $25,000. Straight-line method of depreciation is used #4 CJE #5 Income) Stalement #6 Retained Earnings Balance Sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts