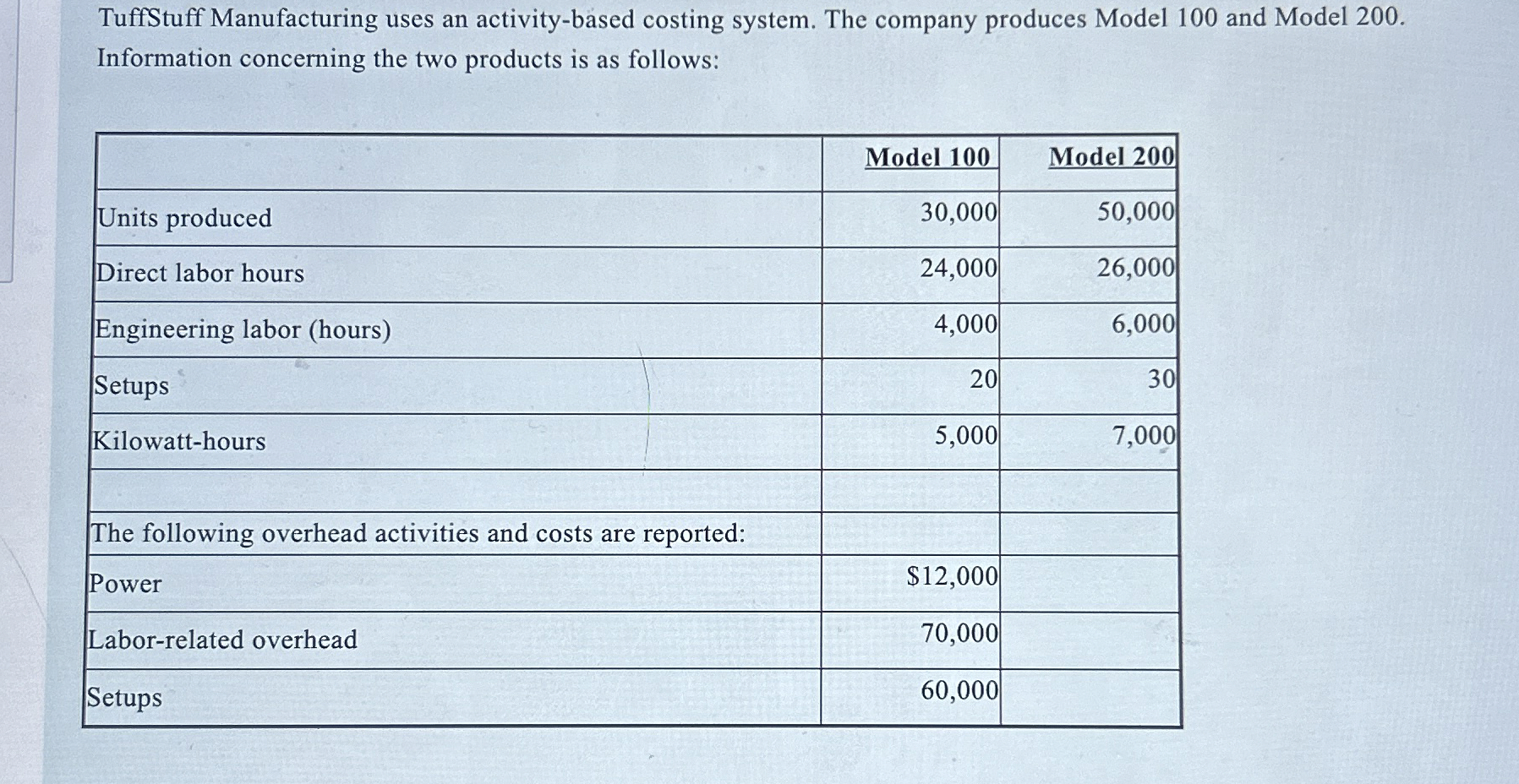

Question: TuffStuff Manufacturing uses an activity - based costing system. The company produces Model 1 0 0 and Model 2 0 0 . Information concerning the

TuffStuff Manufacturing uses an activitybased costing system. The company produces Model and Model Information concerning the two products is as follows:

tableModel Model Units produced,Direct labor hours,Engineering labor hoursSetupsKilowatthours,The following overhead activities and costs are reported:,,Power$Laborrelated overhead,Setups

TuffStuff Manufacturing uses an activitybased costing system. The company produces Model and Model Information concerning the two products is as follows:

tableModel Model Units produced,Direct labor hours,Engineering labor hoursSetupsKilowatthours,$The following overhead activities and costs are reported:,PowerLaborrelated overhead,,Setups

Calculate the following:

A Activity rate for power

B Activity rate for setups

C Activity rate for engineering

D Power costs assigned to Model

E Setups costs assigned to Model

F Engineering costs assigned to Model

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock