Question: tultuave you would recommend. Explain your choice. LO Problem 10-21B Using net present value and payback period to evaluate investment opportunities Wonda Munro just won

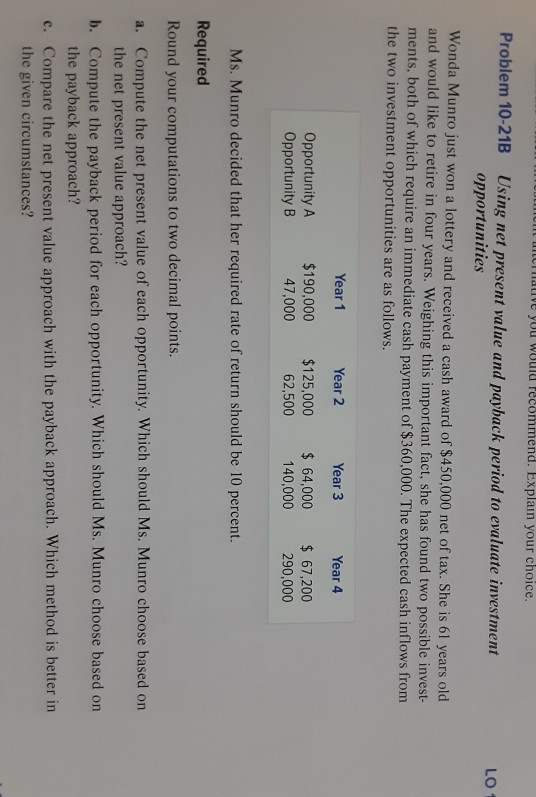

tultuave you would recommend. Explain your choice. LO Problem 10-21B Using net present value and payback period to evaluate investment opportunities Wonda Munro just won a lottery and received a cash award of $450,000 net of tax. She is 61 years old and would like to retire in four years. Weighing this important fact, she has found two possible invest- ments, both of which require an immediate cash payment of $360,000. The expected cash inflows from the two investment opportunities are as follows. Year 1 Year 2 Year 3 Year 4 Opportunity A Opportunity B $190,000 47,000 $125,000 62,500 $ 64,000 140,000 $ 67,200 290,000 Ms. Munro decided that her required rate of return should be 10 percent. Required Round your computations to two decimal points. a. Compute the net present value of each opportunity. Which should Ms. Munro choose based on the net present value approach? b. Compute the payback period for each opportunity. Which should Ms. Munro choose based on the payback approach? c. Compare the net present value approach with the payback approach. Which method is better in the given circumstances

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts