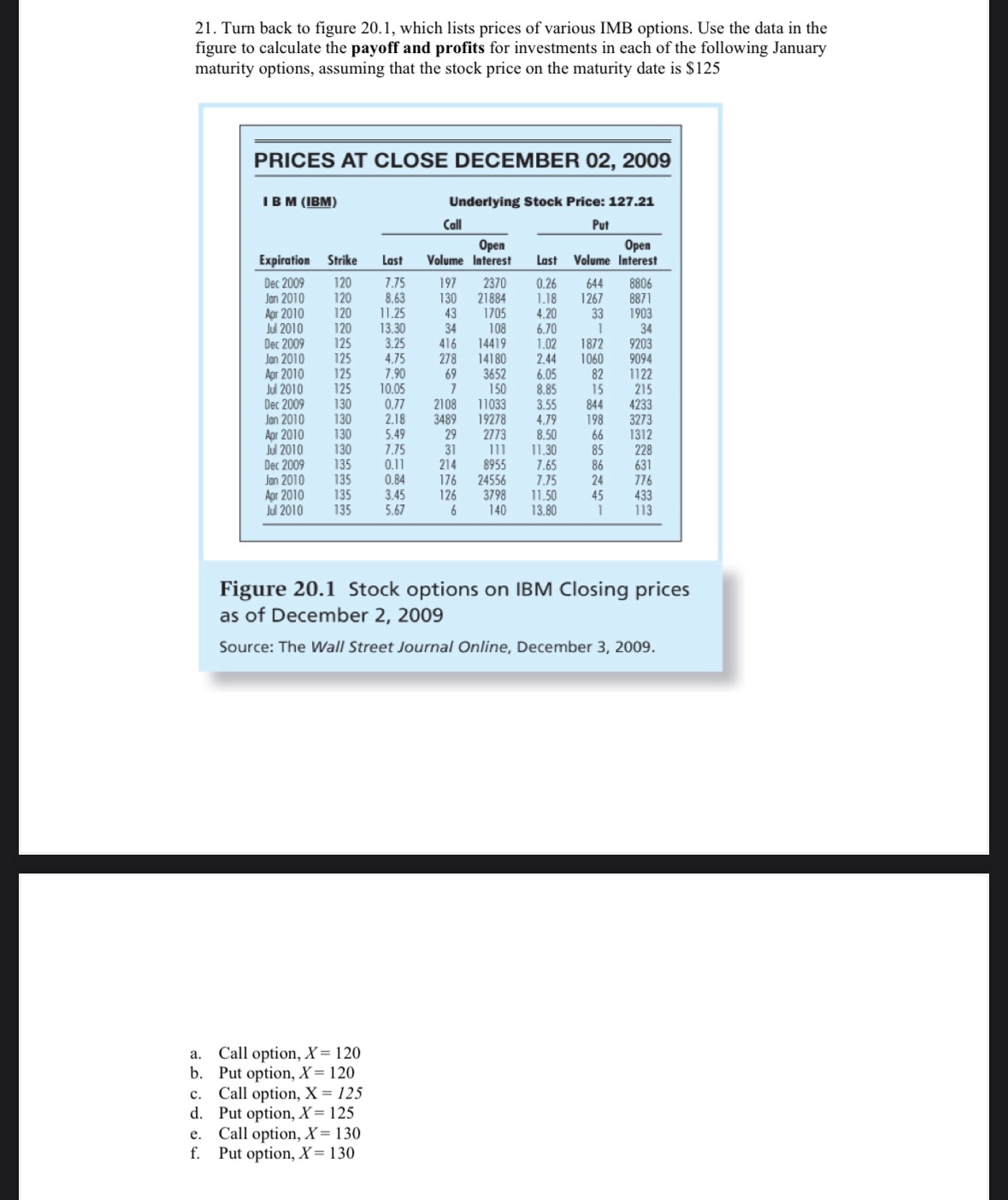

Question: Turn back to figure 2 0 . 1 , which lists prices of various IMB options. Use the data in the figure to calculate the

Turn back to figure which lists prices of various IMB options. Use the data in the figure to calculate the payoff and profits for investments in each of the following January maturity options, assuming that the stock price on the maturity date is $

tablePRICES AT CLOSE DECEMBER I B M IBMUnderlying Stock Price: Call,,,Put,ExpirationStrike,Last,Volume,Open Interest,Last,Volume,Open InterestDec Jen Atar Jet Dec Jon Aor Jd Dec Jen Agr Jot Dec Jen Afr Ju

Figure Stock options on IBM Closing prices as of December

Source: The Wall Street Journal Online, December

a Call option,

b Put option,

c Call option,

d Put option,

e Call option,

f Put option,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock