Question: Turn this information into an excel sheets with the excel formulas being shown P12.2 (LO 1, 2) (Liability Entries and Adjustments) Listed below are selected

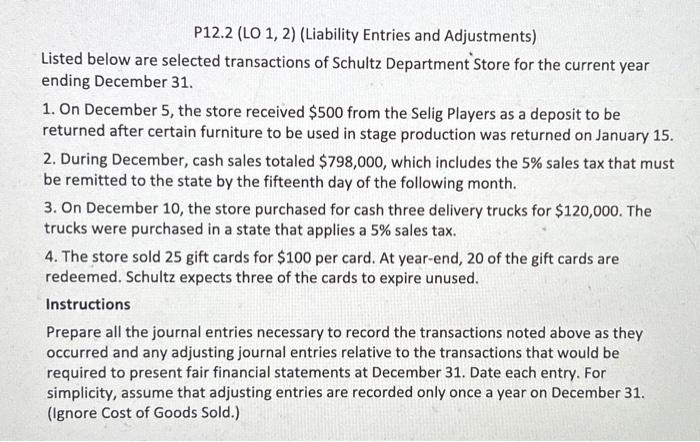

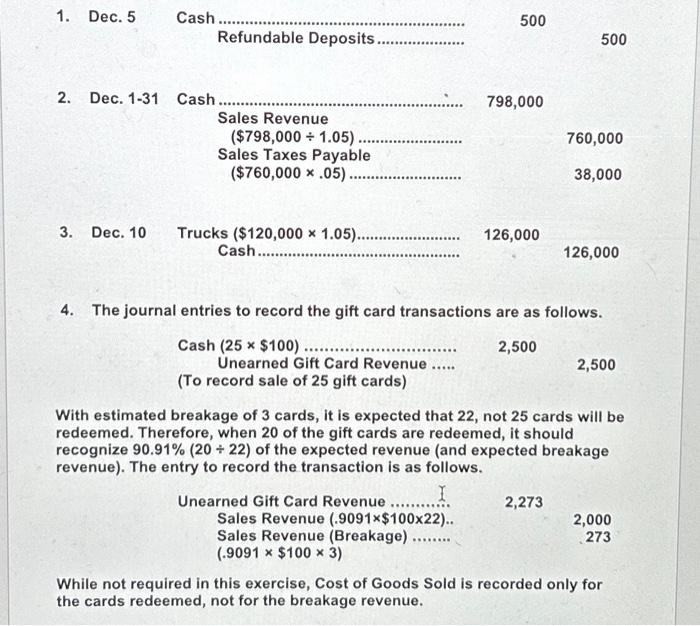

P12.2 (LO 1, 2) (Liability Entries and Adjustments) Listed below are selected transactions of Schultz Department Store for the current year ending December 31. 1. On December 5, the store received $500 from the Selig Players as a deposit to be returned after certain furniture to be used in stage production was returned on January 15. 2. During December, cash sales totaled $798,000, which includes the 5% sales tax that must be remitted to the state by the fifteenth day of the following month. 3. On December 10, the store purchased for cash three delivery trucks for $120,000. The trucks were purchased in a state that applies a 5% sales tax. 4. The store sold 25 gift cards for $100 per card. At year-end, 20 of the gift cards are redeemed. Schultz expects three of the cards to expire unused. Instructions Prepare all the journal entries necessary to record the transactions noted above as they occurred and any adjusting journal entries relative to the transactions that would be required to present fair financial statements at December 31. Date each entry. For simplicity, assume that adjusting entries are recorded only once a year on December 31. (Ignore Cost of Goods Sold.)

Step by Step Solution

There are 3 Steps involved in it

Here are the journal entries for the transactions 1 December 5 Cash 500 Refundable Deposits 500 2 De... View full answer

Get step-by-step solutions from verified subject matter experts