Question: Turner Hardware is adding a new product line that will require an investment of $1,480,000. Managers estimate that this investment will have a 10-year life

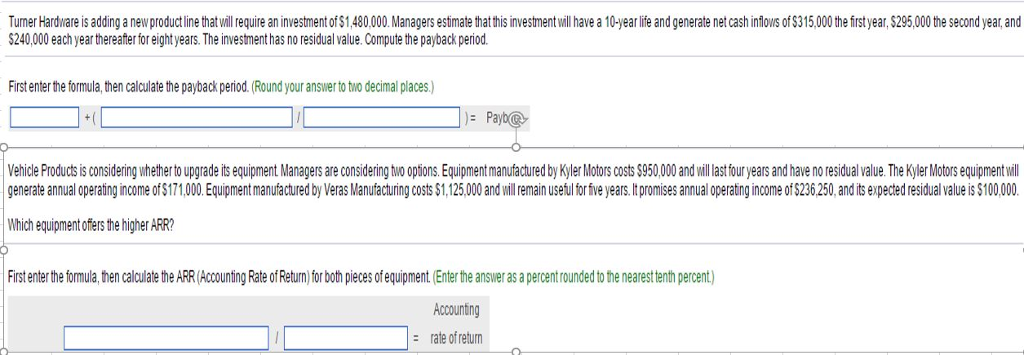

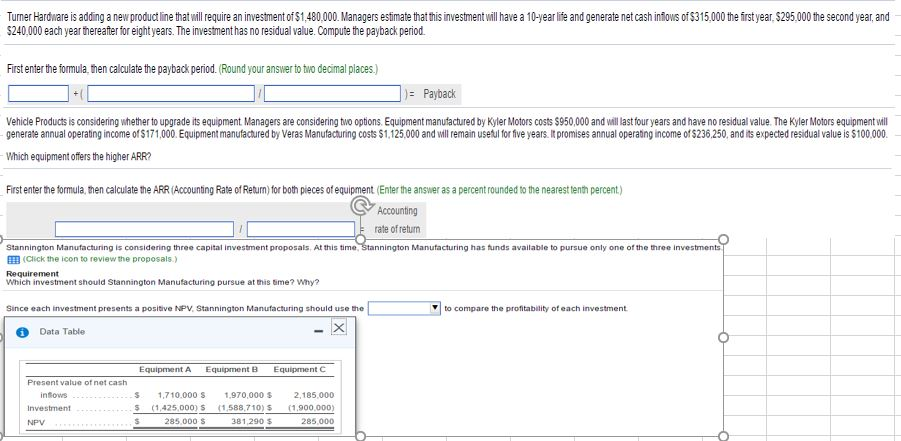

Turner Hardware is adding a new product line that will require an investment of $1,480,000. Managers estimate that this investment will have a 10-year life and generals net cash inflow of $315,000 the first year, $295,000 the second year, and $240,000 each year thereafter for eight years. The investment has no residual value. Compute the payback period. First enter the formula, then calculate the payback period. (Round your answer to too decimal places.) Vehicle Products is considering whether to upgrade its equipment Managers are considering two options. Equipment manufactured by Kyler Motors costs $950,000 and will last four years and have no residual value. The Kyler Motors equipment will generate annual operating income of $171,000. Equipment manufactured by Veras Manufacturing costs $1,125,000 and will remain useful for five years. It promises annual operating income of $236,250, and its expected residual value is $100,000. Which equipment offers the higher ARR? First enter the formula, hen calculate the ARR (Accounting Rate of Return) for both pieces of equipment (Enter the answer as a percent rounded to me nearest tenth percent) Turner Hardware is adding a new product line that will require an investment of $1,480,000. Managers estimate that this Investment will have a 10-year life and generate net cash inflows of $315,000 the first year, $295,000 the second year, and $240,000 each year thereafter for eight years. The investment has no residual value. Compute the payback period. First enter the formula then calculate the payback period. (Round your answer to two decanal places) Vehicle Products is considering whether to upgrade its equipment Managers are considering two options. Equipment manufactured by Kyler Motors costs $950,000 and will last four years and have no residual value The Kyler Motors equipment will generate annual operating income of $171,000 Equipment manufactured by Veras Manufacturing costs $1,125,000 and will remain useful for five years it promises annual operating income of $236,250 and its expected residual value is $100,000. Which equipment offers the higher ARR? First enter the formula men calculate me APR (Accounting Rate of Return) for both pieces of equipment (Enter the answer as a percent rounded to the nearest tenth percent) Manufacturing is considering is considering three capital investment proposals. At this times. Stannington Manufacturing has funds available to pursue only one of the three investments. Requirement Which investment should Stannington Manufacturing pursue at this time? Why? Since each investment presents a positive NPV, Stannington Manufacturing should use the to compare the profitability of each investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts