Question: Turning Circle Driving School Pty Ltd , a base rate entity, prepared the following Income Statement for 2 0 2 2 / 2 3 INCOME

Turning Circle Driving School Pty Ltd a base rate entity, prepared the following Income Statement for

INCOME

Gross fees $

Fully Frank Dividend note $

Unfranked Dividend $

Total $

EXPENSES

Fines & Penalties $

Depreciation note $

Other Deductible expenditure $

Total $

NET PROFIT $ Income expenses

Note The deduction for decline in value using tax rates was $

Note The company commenced business in as a limousine service. On August all the companys shares were sold to the Bean family. On October the company ceased its limousine service and began operating as a driving instructor service. The company had incurred the following tax losses:

$

$

$

Note Franking credit was $

REQUIRED:

Using the template provided:

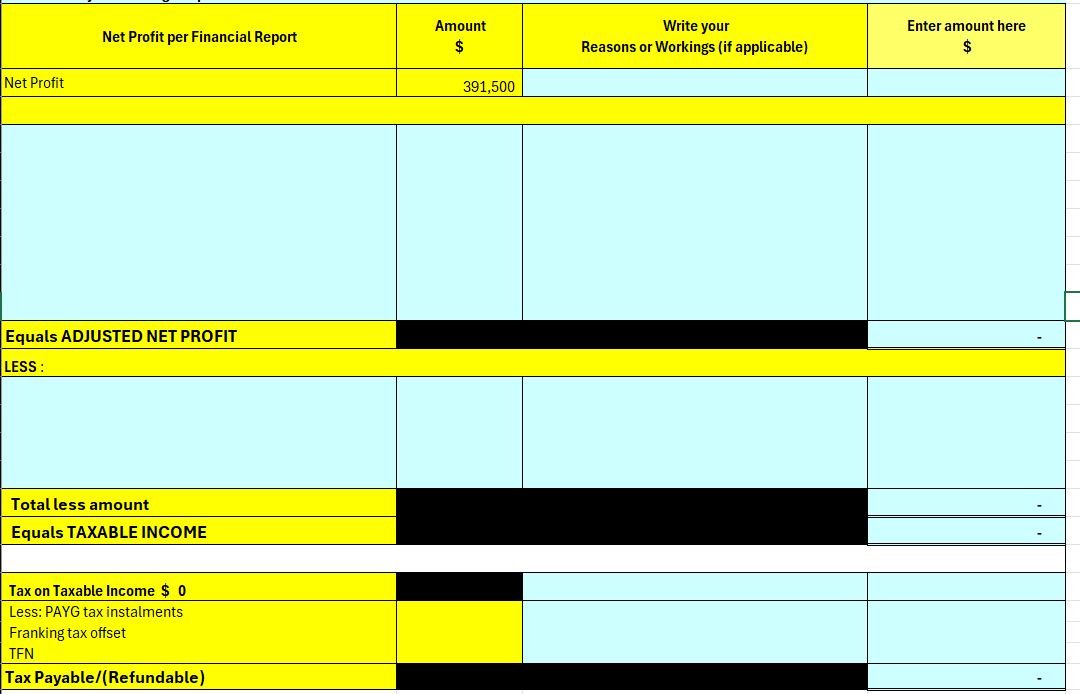

a Prepare a statement reconciling net profit with taxable income for the tax year.

b Calculate tax payable for the tax year.Please update answer as per excel format. Please make a note when calculate : Fully franked dividend and unfranked dividend. For offset previous Losses : Compare The income full year with each of the full years for the each of the loss years, if either test passed allow the Driving school and limousine service are not similar businesses Check Continuity of ownership test

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock