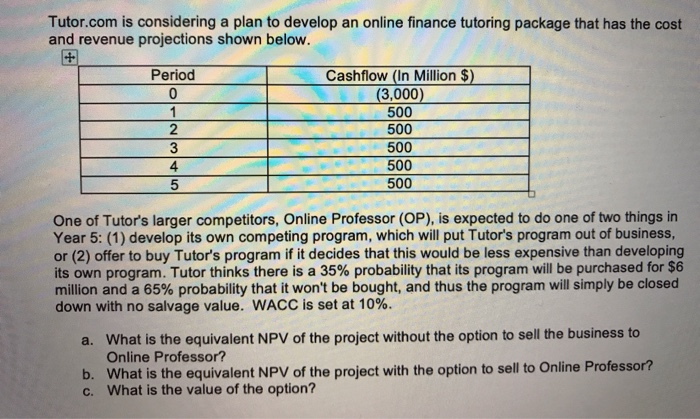

Question: Tutor.com is considering a plan to develop an online finance tutoring package that has the cost and revenue projections shown below. Period 0 2 3

Tutor.com is considering a plan to develop an online finance tutoring package that has the cost and revenue projections shown below. Period 0 2 3 4 5 Cashflow (In Million $) (3,000) 500 500 500 500 500 One of Tutor's larger competitors, Online Professor (OP), is expected to do one of two things in Year 5: (1) develop its own competing program, which will put Tutor's program out of business, or (2) offer to buy Tutor's program if it decides that this would be less expensive than developing its own program. Tutor thinks there is a 35% probability that its program will be purchased for $6 million and a 65% probability that it won't be bought, and thus the program will simply be closed down with no salvage value. WACC is set at 10%. a. What is the equivalent NPV of the project without the option to sell the business to Online Professor? b. What is the equivalent NPV of the project with the option to sell to Online Professor? c. What is the value of the option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts