Question: TUTORIAL 1 - COMPANY TAXATION QUESTION ABC Sdn Bhd commenced its business of manufacturing canned fruits since 2000. The company's product brand is sold in

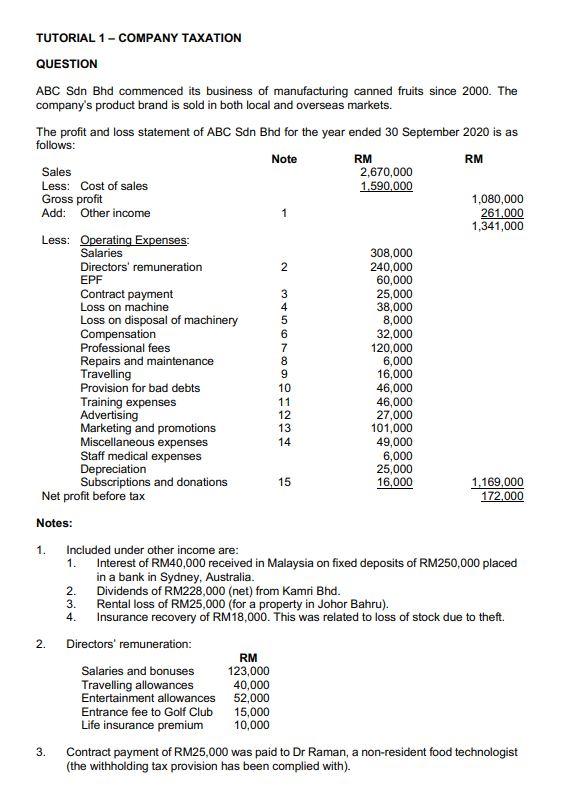

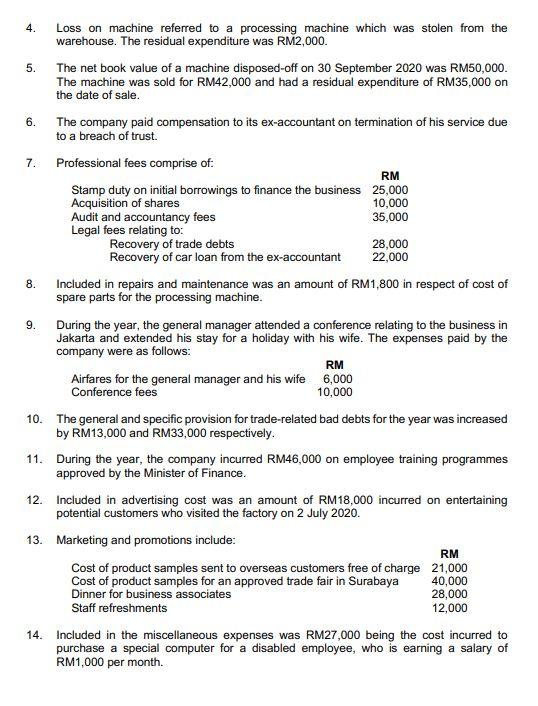

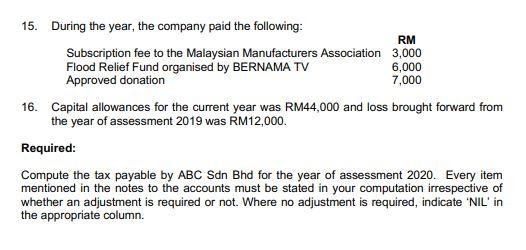

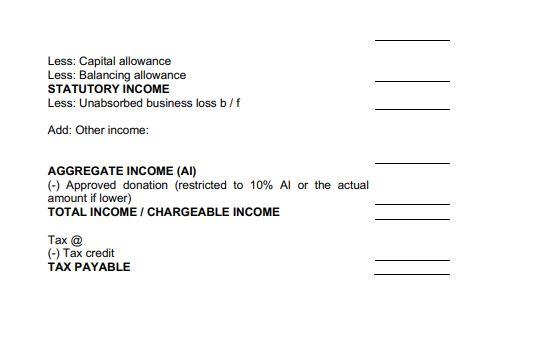

TUTORIAL 1 - COMPANY TAXATION QUESTION ABC Sdn Bhd commenced its business of manufacturing canned fruits since 2000. The company's product brand is sold in both local and overseas markets. The profit and loss statement of ABC Sdn Bhd for the year ended 30 September 2020 is as follows: Note RM RM Sales 2,670,000 Less: Cost of sales 1.590,000 Gross profit 1,080,000 Add: Other income 1 261,000 1,341,000 Less: Operating Expenses: Salaries 308,000 Directors' remuneration 2 240,000 EPF 60,000 Contract payment 25,000 Loss on machine 38,000 Loss on disposal of machinery 8,000 Compensation 32,000 Professional fees 120,000 Repairs and maintenance 6,000 Travelling 16,000 Provision for bad debts 46,000 Training expenses 11 46,000 Advertising 12 27,000 Marketing and promotions 13 101,000 Miscellaneous expenses 14 49,000 Staff medical expenses 6,000 Depreciation 25,000 Subscriptions and donations 16,000 1,169,000 Net profit before tax 172,000 Notes: 1. Included under other income are: 1. Interest of RM40,000 received in Malaysia on fixed deposits of RM250,000 placed in a bank in Sydney, Australia. 2. Dividends of RM228,000 (net) from Kamri Bhd. 3. Rental loss of RM25,000 (for a property in Johor Bahru). 4. Insurance recovery of RM 18,000. This was related to loss of stock due to theft 2. Directors' remuneration: RM Salaries and bonuses 123,000 Travelling allowances 40,000 Entertainment allowances 52,000 Entrance fee to Golf Club 15,000 Life insurance premium 10,000 3. Contract payment of RM25,000 was paid to Dr Raman, a non-resident food technologist (the withholding tax provision has been complied with). 345678gp=294 15 5. 6. 8. 9. 4. Loss on machine referred to a processing machine which was stolen from the warehouse. The residual expenditure was RM2,000. The net book value of a machine disposed-off on 30 September 2020 was RM50,000. The machine was sold for RM42,000 and had a residual expenditure of RM35,000 on the date of sale. The company paid compensation to its ex-accountant on termination of his service due to a breach of trust. 7. Professional fees comprise of: RM Stamp duty on initial borrowings to finance the business 25,000 Acquisition of shares 10,000 Audit and accountancy fees 35,000 Legal fees relating to: Recovery of trade debts 28,000 Recovery of car loan from the ex-accountant 22,000 . Included in repairs and maintenance was an amount of RM1,800 in respect of cost of spare parts for the processing machine. During the year, the general manager attended a conference relating to the business in Jakarta and extended his stay for a holiday with his wife. The expenses paid by the company were as follows: RM Airfares for the general manager and his wife 6,000 Conference fees 10,000 10. The general and specific provision for trade-related bad debts for the year was increased by RM13,000 and RM33,000 respectively. 11. During the year, the company incurred RM46,000 on employee training programmes approved by the Minister of Finance. 12. Included in advertising cost was an amount of RM18,000 incurred on entertaining potential customers who visited the factory on 2 July 2020. 13. Marketing and promotions include: RM Cost of product samples sent to overseas customers free of charge 21,000 Cost of product samples for an approved trade fair in Surabaya 40,000 Dinner for business associates 28,000 Staff refreshments 12,000 14. Included in the miscellaneous expenses was RM27,000 being the cost incurred to purchase a special computer for a disabled employee, who is earning a salary of RM1,000 per month 15. During the year, the company paid the following: RM Subscription fee to the Malaysian Manufacturers Association 3,000 Flood Relief Fund organised by BERNAMA TV 6,000 Approved donation 7,000 16. Capital allowances for the current year was RM44,000 and loss brought forward from the year of assessment 2019 was RM12,000. Required: Compute the tax payable by ABC Sdn Bhd for the year of assessment 2020. Every item mentioned in the notes to the accounts must be stated in your computation irrespective of whether an adjustment is required or not. Where no adjustment is required, indicate "NIL' in the appropriate column RM RM CALCULATION FORMAT Computation of Tax Payable by ABC Sdn Bhd for YA 2020 Section 4a Net profit before tax Less: Other income Interest Dividend Rental loss Insurance Add: Expenses not tax deductible Salaries Directors' remuneration: - Salaries & bonuses - Travelling allowances - Entertainment allowances - Entrance fees to golf club - Life insurance premium EPF Contract payment Loss on machine Loss on disposal of machinery Compensation on termination of employment Professional fees: - Stamp duty - Acquisition of shares - Audit & accountancy fees - Legal fees - recovery of trade debts - Legal fees - recovery of car loan Repairs & maintenance Travelling - Airfares Travelling - Conference fees General provision for trade-related bad debt Specific provision for trade-related bad debt Training programmes Advertising Marketing: - Product samples sent to overseas - Product sample for an approved trade fair - Dinner for business associates - Staff refreshment Miscellaneous expenses - special computer Miscellaneous expenses - salary to disable employee Staff medical expenses Depreciation Subscriptions & donations - MMA Subscriptions & donations - food relief fund Subscriptions & donations - approved donation ADJUSTED INCOME Add: Balancing charge Less: Capital allowance Less: Balancing allowance STATUTORY INCOME Less: Unabsorbed business loss b/f Add: Other income: AGGREGATE INCOME (AI) (-) Approved donation (restricted to 10% Al or the actual amount if lower) TOTAL INCOME / CHARGEABLE INCOME Tax @ (-) Tax credit TAX PAYABLE TUTORIAL 1 - COMPANY TAXATION QUESTION ABC Sdn Bhd commenced its business of manufacturing canned fruits since 2000. The company's product brand is sold in both local and overseas markets. The profit and loss statement of ABC Sdn Bhd for the year ended 30 September 2020 is as follows: Note RM RM Sales 2,670,000 Less: Cost of sales 1.590,000 Gross profit 1,080,000 Add: Other income 1 261,000 1,341,000 Less: Operating Expenses: Salaries 308,000 Directors' remuneration 2 240,000 EPF 60,000 Contract payment 25,000 Loss on machine 38,000 Loss on disposal of machinery 8,000 Compensation 32,000 Professional fees 120,000 Repairs and maintenance 6,000 Travelling 16,000 Provision for bad debts 46,000 Training expenses 11 46,000 Advertising 12 27,000 Marketing and promotions 13 101,000 Miscellaneous expenses 14 49,000 Staff medical expenses 6,000 Depreciation 25,000 Subscriptions and donations 16,000 1,169,000 Net profit before tax 172,000 Notes: 1. Included under other income are: 1. Interest of RM40,000 received in Malaysia on fixed deposits of RM250,000 placed in a bank in Sydney, Australia. 2. Dividends of RM228,000 (net) from Kamri Bhd. 3. Rental loss of RM25,000 (for a property in Johor Bahru). 4. Insurance recovery of RM 18,000. This was related to loss of stock due to theft 2. Directors' remuneration: RM Salaries and bonuses 123,000 Travelling allowances 40,000 Entertainment allowances 52,000 Entrance fee to Golf Club 15,000 Life insurance premium 10,000 3. Contract payment of RM25,000 was paid to Dr Raman, a non-resident food technologist (the withholding tax provision has been complied with). 345678gp=294 15 5. 6. 8. 9. 4. Loss on machine referred to a processing machine which was stolen from the warehouse. The residual expenditure was RM2,000. The net book value of a machine disposed-off on 30 September 2020 was RM50,000. The machine was sold for RM42,000 and had a residual expenditure of RM35,000 on the date of sale. The company paid compensation to its ex-accountant on termination of his service due to a breach of trust. 7. Professional fees comprise of: RM Stamp duty on initial borrowings to finance the business 25,000 Acquisition of shares 10,000 Audit and accountancy fees 35,000 Legal fees relating to: Recovery of trade debts 28,000 Recovery of car loan from the ex-accountant 22,000 . Included in repairs and maintenance was an amount of RM1,800 in respect of cost of spare parts for the processing machine. During the year, the general manager attended a conference relating to the business in Jakarta and extended his stay for a holiday with his wife. The expenses paid by the company were as follows: RM Airfares for the general manager and his wife 6,000 Conference fees 10,000 10. The general and specific provision for trade-related bad debts for the year was increased by RM13,000 and RM33,000 respectively. 11. During the year, the company incurred RM46,000 on employee training programmes approved by the Minister of Finance. 12. Included in advertising cost was an amount of RM18,000 incurred on entertaining potential customers who visited the factory on 2 July 2020. 13. Marketing and promotions include: RM Cost of product samples sent to overseas customers free of charge 21,000 Cost of product samples for an approved trade fair in Surabaya 40,000 Dinner for business associates 28,000 Staff refreshments 12,000 14. Included in the miscellaneous expenses was RM27,000 being the cost incurred to purchase a special computer for a disabled employee, who is earning a salary of RM1,000 per month 15. During the year, the company paid the following: RM Subscription fee to the Malaysian Manufacturers Association 3,000 Flood Relief Fund organised by BERNAMA TV 6,000 Approved donation 7,000 16. Capital allowances for the current year was RM44,000 and loss brought forward from the year of assessment 2019 was RM12,000. Required: Compute the tax payable by ABC Sdn Bhd for the year of assessment 2020. Every item mentioned in the notes to the accounts must be stated in your computation irrespective of whether an adjustment is required or not. Where no adjustment is required, indicate "NIL' in the appropriate column RM RM CALCULATION FORMAT Computation of Tax Payable by ABC Sdn Bhd for YA 2020 Section 4a Net profit before tax Less: Other income Interest Dividend Rental loss Insurance Add: Expenses not tax deductible Salaries Directors' remuneration: - Salaries & bonuses - Travelling allowances - Entertainment allowances - Entrance fees to golf club - Life insurance premium EPF Contract payment Loss on machine Loss on disposal of machinery Compensation on termination of employment Professional fees: - Stamp duty - Acquisition of shares - Audit & accountancy fees - Legal fees - recovery of trade debts - Legal fees - recovery of car loan Repairs & maintenance Travelling - Airfares Travelling - Conference fees General provision for trade-related bad debt Specific provision for trade-related bad debt Training programmes Advertising Marketing: - Product samples sent to overseas - Product sample for an approved trade fair - Dinner for business associates - Staff refreshment Miscellaneous expenses - special computer Miscellaneous expenses - salary to disable employee Staff medical expenses Depreciation Subscriptions & donations - MMA Subscriptions & donations - food relief fund Subscriptions & donations - approved donation ADJUSTED INCOME Add: Balancing charge Less: Capital allowance Less: Balancing allowance STATUTORY INCOME Less: Unabsorbed business loss b/f Add: Other income: AGGREGATE INCOME (AI) (-) Approved donation (restricted to 10% Al or the actual amount if lower) TOTAL INCOME / CHARGEABLE INCOME Tax @ (-) Tax credit TAX PAYABLE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts