Question: TUTORIAL 10 PARTNERSHIP ACCOUNT QUESTION 1 Sofea & Co. was established a few years ago founded by Sofea and Amanda. The business went well until

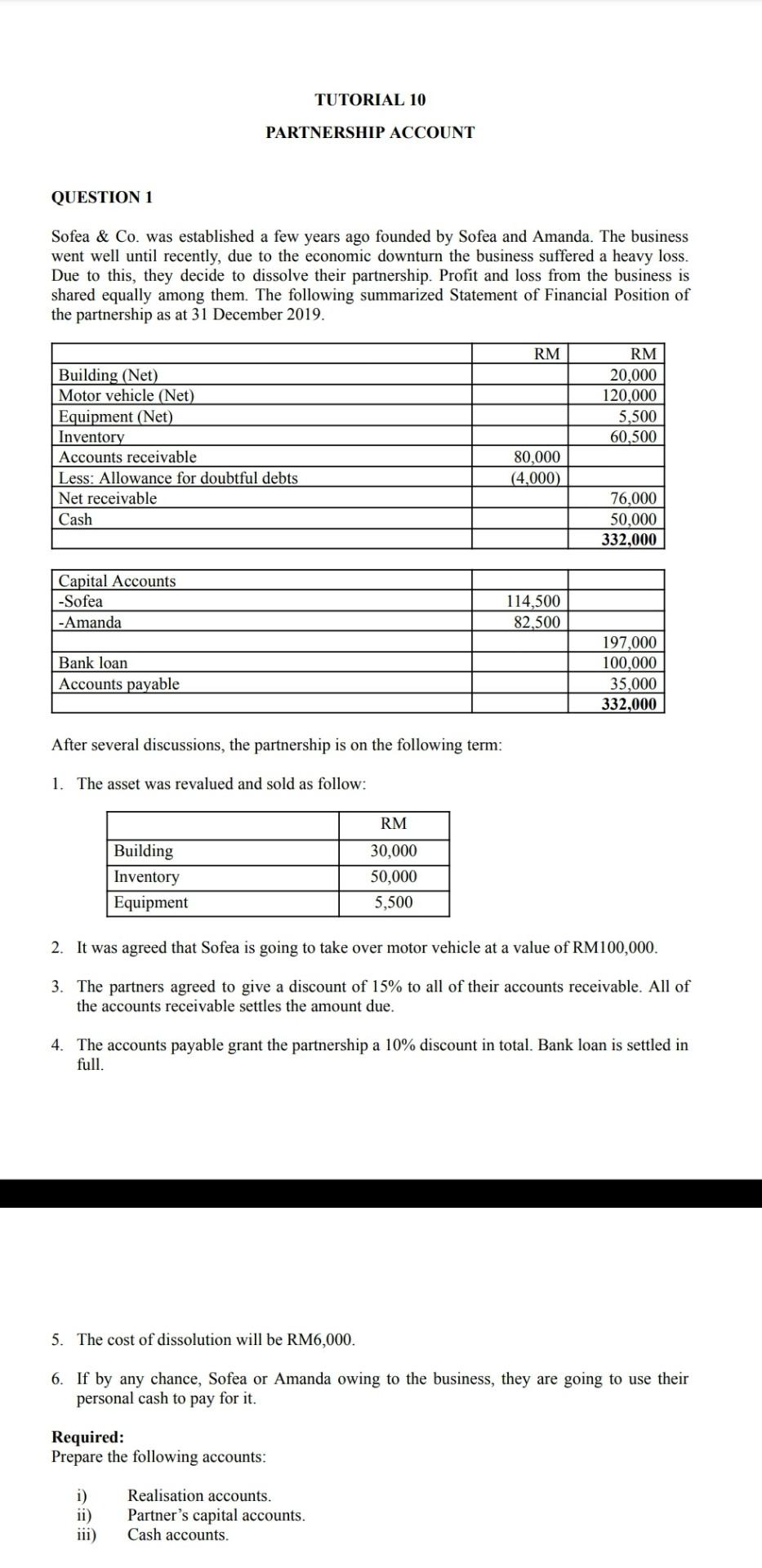

TUTORIAL 10 PARTNERSHIP ACCOUNT QUESTION 1 Sofea \& Co. was established a few years ago founded by Sofea and Amanda. The business went well until recently, due to the economic downturn the business suffered a heavy loss. Due to this, they decide to dissolve their partnership. Profit and loss from the business is shared equally among them. The following summarized Statement of Financial Position of the partnership as at 31 December 2019. After several discussions, the partnership is on the following term: 1. The asset was revalued and sold as follow: 2. It was agreed that Sofea is going to take over motor vehicle at a value of RM100,000. 3. The partners agreed to give a discount of 15% to all of their accounts receivable. All of the accounts receivable settles the amount due. 4. The accounts payable grant the partnership a 10% discount in total. Bank loan is settled in full. 5. The cost of dissolution will be RM6,000. 6. If by any chance, Sofea or Amanda owing to the business, they are going to use their personal cash to pay for it. Required: Prepare the following accounts: i) Realisation accounts. ii) Partner's capital accounts. iii) Cash accounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts