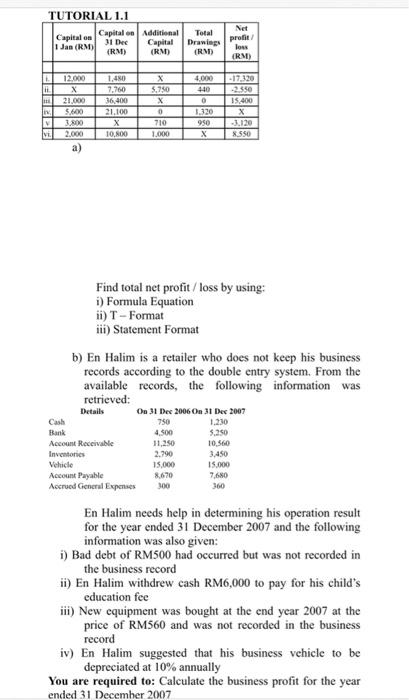

Question: TUTORIAL 1.1 Capital on 1 Jan (RM) Capital on 31 Dec (RM) Additional Capital (RM) Total Drawings (RM) vi 12.000 X 21.000 5,600 3.800 2.000

TUTORIAL 1.1 Capital on Capital on Additional 1 Jan (RM) 31 Dec Capital (RM) (RM) Total Drawings (RM) Net profit loss (RM) 1 li 4.000 440 12.000 X 20.000 5.600 00 2.000 1,480 7,760 36,400 21.100 10 NDO 5.250 X 0 710 1.000 17120 -2550 15.400 X 1120 X 550 3.320 950 VE Find total net profit/loss by using: 1) Formula Equation ii) T-Format iii) Statement Format b) En Halim is a retailer who does not keep his business records according to the double entry system. From the available records, the following information was retrieved: Details On 31 Dec 2006 On 31 Dec 2007 Cash 750 1.230 Bank 4.500 5.250 Account Receivable 11.250 10.560 Inventories 2.790 3.450 Vehicle 15.000 15.000 Account Payable 8.670 7,680 Accrued General Expenses 300 En Halim needs help in determining his operation result for the year ended 31 December 2007 and the following information was also given: i) Bad debt of RM500 had occurred but was not recorded in the business record ii) En Halim withdrew cash RM6,000 to pay for his child's education fee iii) New equipment was bought at the end year 2007 at the price of RM560 and was not recorded in the business record iv) En Halim suggested that his business vehicle to be depreciated at 10% annually You are required to: Calculate the business profit for the year ended 31 December 2007 TUTORIAL 1.1 Capital on Capital on Additional 1 Jan (RM) 31 Dec Capital (RM) (RM) Total Drawings (RM) Net profit loss (RM) 1 li 4.000 440 12.000 X 20.000 5.600 00 2.000 1,480 7,760 36,400 21.100 10 NDO 5.250 X 0 710 1.000 17120 -2550 15.400 X 1120 X 550 3.320 950 VE Find total net profit/loss by using: 1) Formula Equation ii) T-Format iii) Statement Format b) En Halim is a retailer who does not keep his business records according to the double entry system. From the available records, the following information was retrieved: Details On 31 Dec 2006 On 31 Dec 2007 Cash 750 1.230 Bank 4.500 5.250 Account Receivable 11.250 10.560 Inventories 2.790 3.450 Vehicle 15.000 15.000 Account Payable 8.670 7,680 Accrued General Expenses 300 En Halim needs help in determining his operation result for the year ended 31 December 2007 and the following information was also given: i) Bad debt of RM500 had occurred but was not recorded in the business record ii) En Halim withdrew cash RM6,000 to pay for his child's education fee iii) New equipment was bought at the end year 2007 at the price of RM560 and was not recorded in the business record iv) En Halim suggested that his business vehicle to be depreciated at 10% annually You are required to: Calculate the business profit for the year ended 31 December 2007

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts