Question: TUTORIAL 12 (Cost Allocation) Bestum Ltd has two service and two production departments. The following information relates to August 2010: Production departments: Total cost

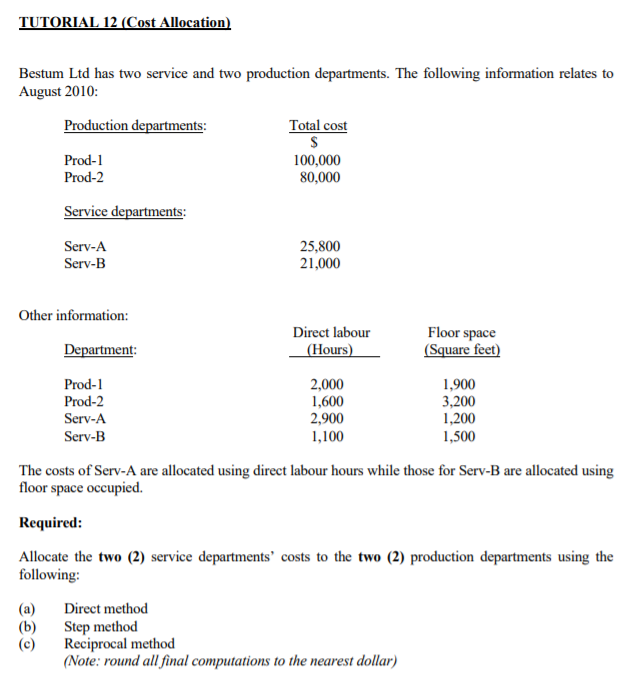

TUTORIAL 12 (Cost Allocation) Bestum Ltd has two service and two production departments. The following information relates to August 2010: Production departments: Total cost $ Prod-1 100,000 Prod-2 80,000 Service departments: Serv-A 25,800 Serv-B 21,000 Other information: Direct labour Department: (Hours) Floor space (Square feet) Prod-1 2,000 1,900 Prod-2 1,600 3,200 Serv-A 2,900 1,200 Serv-B 1,100 1,500 The costs of Serv-A are allocated using direct labour hours while those for Serv-B are allocated using floor space occupied. Required: Allocate the two (2) service departments' costs to the two (2) production departments using the following: (a) Direct method 360 (b) Step method Reciprocal method (Note: round all final computations to the nearest dollar)

Step by Step Solution

There are 3 Steps involved in it

To solve this problem we need to allocate the costs of the two service departments ServA and ServB t... View full answer

Get step-by-step solutions from verified subject matter experts