Question: TUTORIAL 13: PERSONAL ASSESSMENT 1. Mr and Mrs Lo are husband and wife who have lived in Hong Kong for many years. Their income, loss

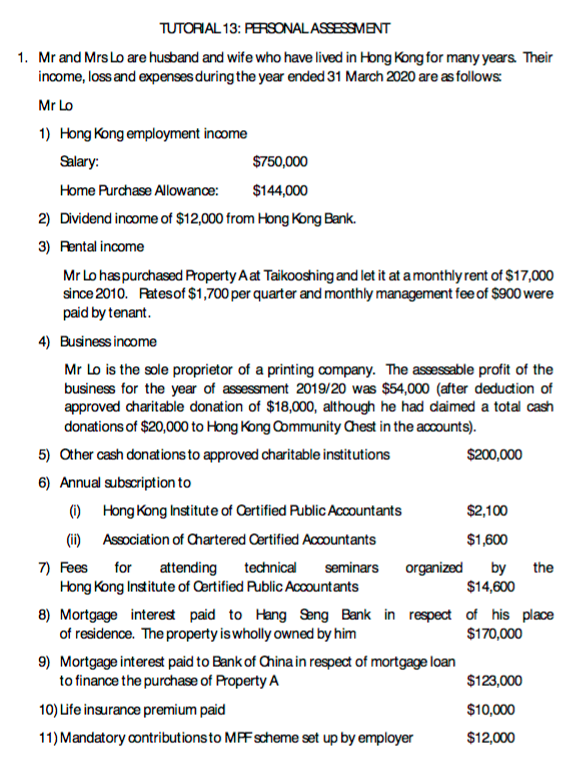

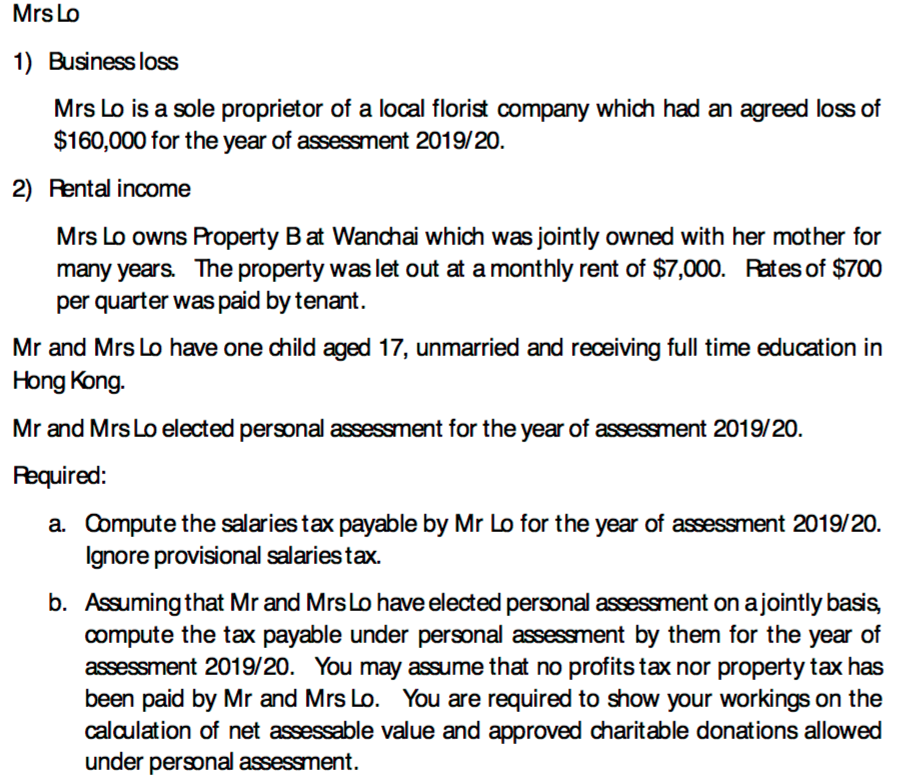

TUTORIAL 13: PERSONAL ASSESSMENT 1. Mr and Mrs Lo are husband and wife who have lived in Hong Kong for many years. Their income, loss and expenses during the year ended 31 March 2020 are as follows: Mr Lo 1) Hong Kong employment income Salary: $750,000 Home Purchase Allowance: $144,000 2) Dividend income of $12,000 from Hong Kong Bank. 3) Pental income Mr Lo has purchased Property A at Taikooshing and let it at a monthly rent of $17,000 since 2010. Rates of $1,700 per quarter and monthly management fee of $900 were paid by tenant. 4) Business income Mr Lo is the sole proprietor of a printing company. The assessable profit of the business for the year of assessment 2019/20 was $54,000 (after deduction of approved charitable donation of $18,000, although he had daimed a total cash donations of $20,000 to Hong Kong Community Chest in the accounts). 5) Other cash donations to approved charitable institutions $200,000 6) Annual subscription to (0) Hong Kong Institute of Certified Public Accountants $2,100 (ii) Association of Chartered Certified Accountants $1,600 7) Fees for attending technical Seminars organized by the Hong Kong Institute of Certified Public Accountants $14,600 8) Mortgage interest paid to Hang Seng Bank in respect of his place of residence. The property is wholly owned by him $170,000 9) Mortgage interest paid to Bank of China in respect of mortgage loan to finance the purchase of Property A $123,000 10) Life insurance premium paid $10,000 11) Mandatory contributions to MPF scheme set up by employer $12,000 Mrs Lo 1) Business loss Mrs Lo is a sole proprietor of a local florist company which had an agreed loss of $160,000 for the year of assessment 2019/20. 2) Pental income Mrs Lo owns Property B at Wanchai which was jointly owned with her mother for many years. The property was let out at a monthly rent of $7,000. Rates of $700 per quarter was paid by tenant. Mr and Mrs Lo have one child aged 17, unmarried and receiving full time education in Hong Kong. Mr and Mrs Lo elected personal assessment for the year of assessment 2019/20. Required: a. Compute the salaries tax payable by Mr Lo for the year of assessment 2019/20. Ignore provisional salaries tax. b. Assuming that Mr and Mrs Lo have elected personal assessment on a jointly basis, compute the tax payable under personal assessment by them for the year of assessment 2019/20. You may assume that no profits tax nor property tax has been paid by Mr and Mrs Lo. You are required to show your workings on the calculation of net assessable value and approved charitable donations allowed under personal assessment. TUTORIAL 13: PERSONAL ASSESSMENT 1. Mr and Mrs Lo are husband and wife who have lived in Hong Kong for many years. Their income, loss and expenses during the year ended 31 March 2020 are as follows: Mr Lo 1) Hong Kong employment income Salary: $750,000 Home Purchase Allowance: $144,000 2) Dividend income of $12,000 from Hong Kong Bank. 3) Pental income Mr Lo has purchased Property A at Taikooshing and let it at a monthly rent of $17,000 since 2010. Rates of $1,700 per quarter and monthly management fee of $900 were paid by tenant. 4) Business income Mr Lo is the sole proprietor of a printing company. The assessable profit of the business for the year of assessment 2019/20 was $54,000 (after deduction of approved charitable donation of $18,000, although he had daimed a total cash donations of $20,000 to Hong Kong Community Chest in the accounts). 5) Other cash donations to approved charitable institutions $200,000 6) Annual subscription to (0) Hong Kong Institute of Certified Public Accountants $2,100 (ii) Association of Chartered Certified Accountants $1,600 7) Fees for attending technical Seminars organized by the Hong Kong Institute of Certified Public Accountants $14,600 8) Mortgage interest paid to Hang Seng Bank in respect of his place of residence. The property is wholly owned by him $170,000 9) Mortgage interest paid to Bank of China in respect of mortgage loan to finance the purchase of Property A $123,000 10) Life insurance premium paid $10,000 11) Mandatory contributions to MPF scheme set up by employer $12,000 Mrs Lo 1) Business loss Mrs Lo is a sole proprietor of a local florist company which had an agreed loss of $160,000 for the year of assessment 2019/20. 2) Pental income Mrs Lo owns Property B at Wanchai which was jointly owned with her mother for many years. The property was let out at a monthly rent of $7,000. Rates of $700 per quarter was paid by tenant. Mr and Mrs Lo have one child aged 17, unmarried and receiving full time education in Hong Kong. Mr and Mrs Lo elected personal assessment for the year of assessment 2019/20. Required: a. Compute the salaries tax payable by Mr Lo for the year of assessment 2019/20. Ignore provisional salaries tax. b. Assuming that Mr and Mrs Lo have elected personal assessment on a jointly basis, compute the tax payable under personal assessment by them for the year of assessment 2019/20. You may assume that no profits tax nor property tax has been paid by Mr and Mrs Lo. You are required to show your workings on the calculation of net assessable value and approved charitable donations allowed under personal assessment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts