Question: TUTORIAL 13 QUESTION 1 Ryan has just had an emergency operation. This is his first medical expense of the year. The followings were the cost

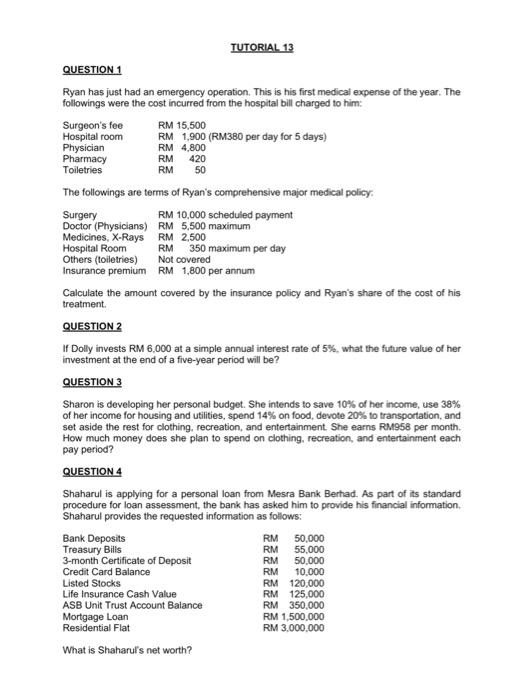

TUTORIAL 13 QUESTION 1 Ryan has just had an emergency operation. This is his first medical expense of the year. The followings were the cost incurred from the hospital bill charged to him Surgeon's fee RM 15,500 Hospital room RM 1,900 (RM380 per day for 5 days) Physician RM 4,800 Pharmacy RM 420 Toiletries RM 50 The followings are terms of Ryan's comprehensive major medical policy Surgery RM 10,000 scheduled payment Doctor (Physicians) RM 5,500 maximum Medicines, X-Rays RM 2,500 Hospital Room RM 350 maximum per day Others (toiletries) Not covered Insurance premium RM 1,800 per annum Calculate the amount covered by the insurance policy and Ryan's share of the cost of his treatment QUESTION 2 If Dolly invests RM 6,000 at a simple annual interest rate of 5%, what the future value of her investment at the end of a five-year period will be? QUESTION 3 Sharon is developing her personal budget. She intends to save 10% of her income, use 38% of her income for housing and utilities, spend 14% on food, devote 20% to transportation, and set aside the rest for clothing, recreation, and entertainment. She earns RM958 per month. How much money does she plan to spend on clothing, recreation, and entertainment each pay period? QUESTION 4 Shaharul is applying for a personal loan from Mesra Bank Berhad. As part of its standard procedure for loan assessment, the bank has asked him to provide his financial information, Shaharul provides the requested information as follows: Bank Deposits RM 50,000 Treasury Bills RM 55.000 3-month Certificate of Deposit RM 50.000 Credit Card Balance RM 10,000 Listed Stocks RM 120,000 Life Insurance Cash Value RM 125.000 ASB Unit Trust Account Balance RM 350.000 Mortgage Loan RM 1,500,000 Residential Flat RM 3,000,000 What is Shaharul's net worth? QUESTION 5 Amin had submitted his proposal for a whole life insurance policy with a sum insured of RM1,000,000 and paid the first premium of RM 2,000. He has passed the medical check-up. and the underwriting process was duly completed. If Amin dies before the policy was issued. how much will his beneficiary recover under the policy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts