Question: Tutorial 5 & 6 Question 1 Suppose that input to a process is 1,000 units at a cost of MVR 4,500. Normal loss is 10%

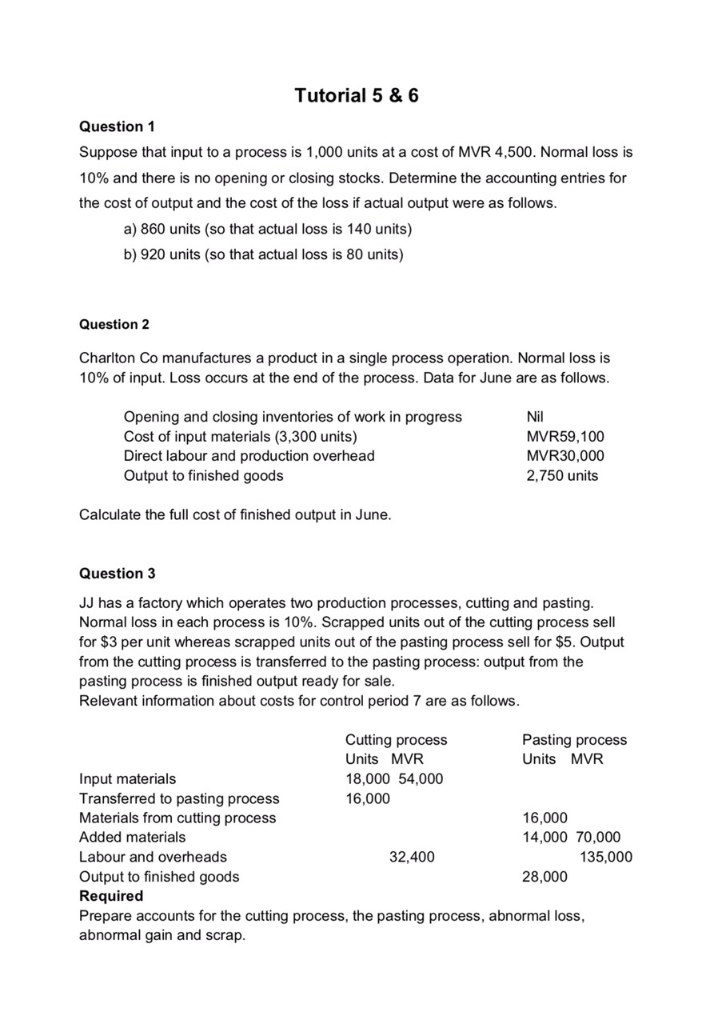

Tutorial 5 & 6 Question 1 Suppose that input to a process is 1,000 units at a cost of MVR 4,500. Normal loss is 10% and there is no opening or closing stocks. Determine the accounting entries for the cost of output and the cost of the loss if actual output were as follows a) 860 units (so that actual loss is 140 units) b) 920 units (so that actual loss is 80 units) Question 2 Charlton Co manufactures a product in a single process operation. Normal loss is 10% of input. Loss occurs at the end of the process. Data for June are as follows Opening and closing inventories of work in progress Cost of input materials (3,300 units) Direct labour and production overhead Output to finished goods Nil MVR59,100 MVR30,000 2,750 units Calculate the full cost of finished output in June Question 3 JJ has a factory which operates two production processes, cutting and pasting Normal loss in each process is 10%. Scrapped units out of the cutting process sell for $3 per unit whereas scrapped units out of the pasting process sell for $5. Output from the cutting process is transferred to the pasting process: output from the pasting process is finished output ready for sale Relevant information about costs for control period 7 are as follows Cutting process Units MVR 18,000 54,000 16,000 Pasting process Units MVR Input materials Transferred to pasting process Materials from cutting process Added materials Labour and overheads Output to finished goods Required Prepare accounts for the cutting process, the pasting process, abnormal loss, abnormal gain and scrap 16,000 14,000 70,000 32,400 135,000 28,000 Tutorial 5 & 6 Question 1 Suppose that input to a process is 1,000 units at a cost of MVR 4,500. Normal loss is 10% and there is no opening or closing stocks. Determine the accounting entries for the cost of output and the cost of the loss if actual output were as follows a) 860 units (so that actual loss is 140 units) b) 920 units (so that actual loss is 80 units) Question 2 Charlton Co manufactures a product in a single process operation. Normal loss is 10% of input. Loss occurs at the end of the process. Data for June are as follows Opening and closing inventories of work in progress Cost of input materials (3,300 units) Direct labour and production overhead Output to finished goods Nil MVR59,100 MVR30,000 2,750 units Calculate the full cost of finished output in June Question 3 JJ has a factory which operates two production processes, cutting and pasting Normal loss in each process is 10%. Scrapped units out of the cutting process sell for $3 per unit whereas scrapped units out of the pasting process sell for $5. Output from the cutting process is transferred to the pasting process: output from the pasting process is finished output ready for sale Relevant information about costs for control period 7 are as follows Cutting process Units MVR 18,000 54,000 16,000 Pasting process Units MVR Input materials Transferred to pasting process Materials from cutting process Added materials Labour and overheads Output to finished goods Required Prepare accounts for the cutting process, the pasting process, abnormal loss, abnormal gain and scrap 16,000 14,000 70,000 32,400 135,000 28,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts