Question: Tutorial 7 MFRS 116 PPE 1. Coco Berhad is a company involves manufacturing various types of paints for home and industrial use. On 10 May

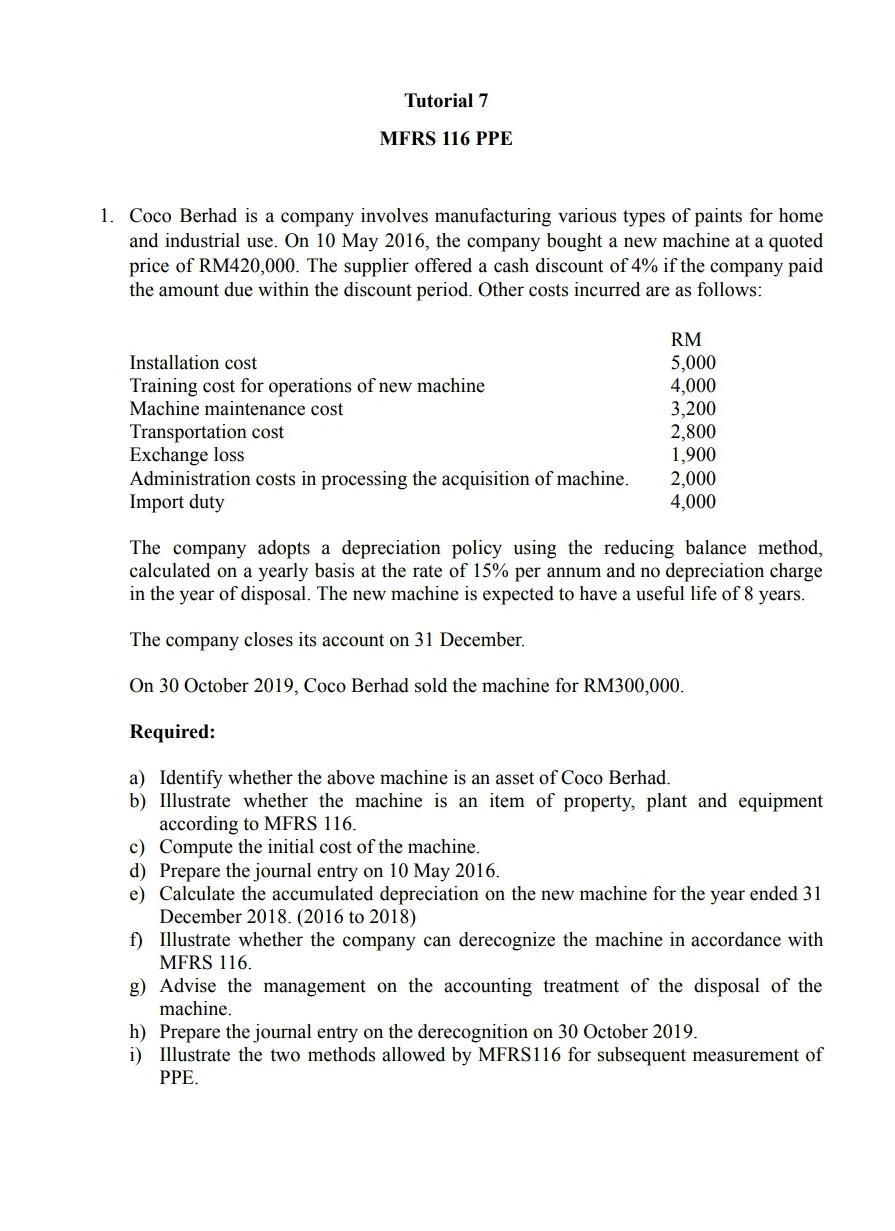

Tutorial 7 MFRS 116 PPE 1. Coco Berhad is a company involves manufacturing various types of paints for home and industrial use. On 10 May 2016, the company bought a new machine at a quoted price of RM420,000. The supplier offered a cash discount of 4% if the company paid the amount due within the discount period. Other costs incurred are as follows: The company adopts a depreciation policy using the reducing balance method, calculated on a yearly basis at the rate of 15% per annum and no depreciation charge in the year of disposal. The new machine is expected to have a useful life of 8 years. The company closes its account on 31 December. On 30 October 2019, Coco Berhad sold the machine for RM300,000. Required: a) Identify whether the above machine is an asset of Coco Berhad. b) Illustrate whether the machine is an item of property, plant and equipment according to MFRS 116. c) Compute the initial cost of the machine. d) Prepare the journal entry on 10 May 2016. e) Calculate the accumulated depreciation on the new machine for the year ended 31 December 2018. (2016 to 2018) f) Illustrate whether the company can derecognize the machine in accordance with MFRS 116. g) Advise the management on the accounting treatment of the disposal of the machine. h) Prepare the journal entry on the derecognition on 30 October 2019. i) Illustrate the two methods allowed by MFRS116 for subsequent measurement of PPE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts