Question: Tutorial: Bad debts and Provision for Doubtful Debts Note to Tutor : Kindly copy and paste these two questions at below and do the workings

Tutorial: Bad debts and Provision for Doubtful Debts

Note to Tutor : Kindly copy and paste these two questions at below and do the workings in Microsoft Excel .

Then do save the file and attach the file to here.

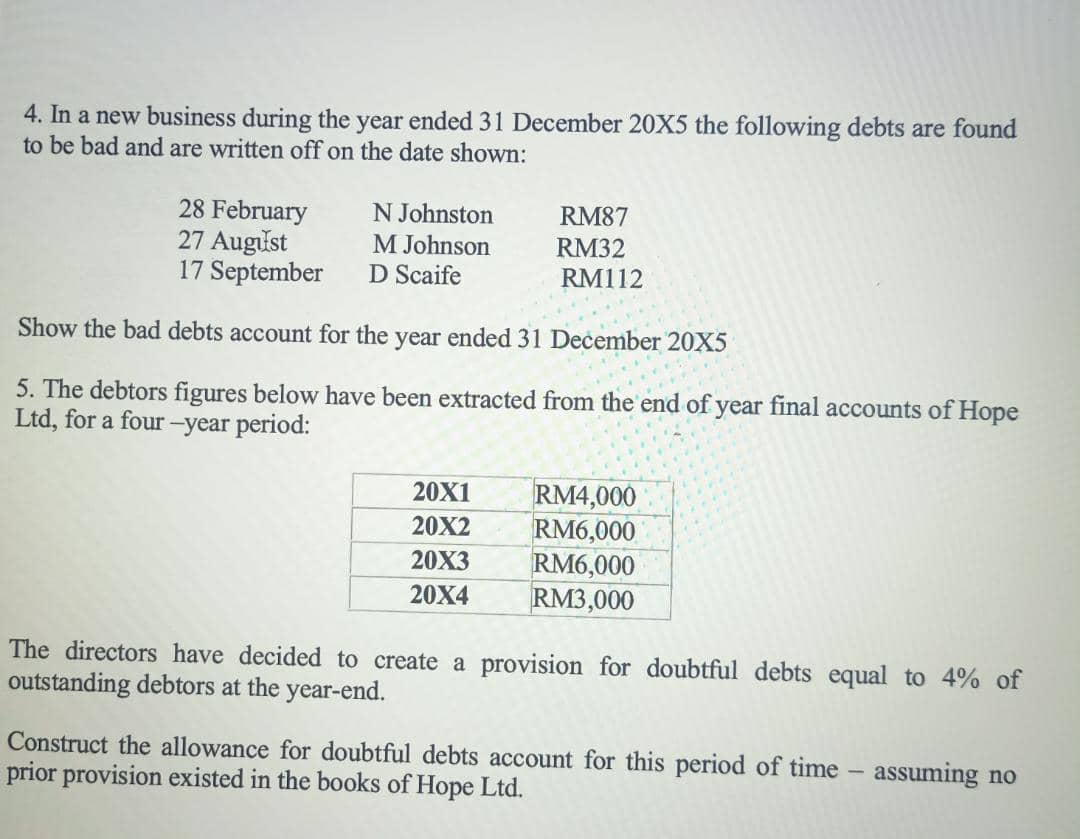

4. In a new business during the year ended 31 December 20X5 the following debts are found to be bad and are written off on the date shown: 28 February N Johnston RM87 27 August M Johnson RM32 17 September D Scaife RM112 Show the bad debts account for the year ended 31 December 20X5 5. The debtors figures below have been extracted from the end of year final accounts of Hope Ltd, for a four -year period: 20X1 RM4,000 20X2 RM6,000 20X3 RM6,000 20X4 RM3,000 The directors have decided to create a provision for doubtful debts equal to 4% of outstanding debtors at the year-end. Construct the allowance for doubtful debts account for this period of time - assuming no prior provision existed in the books of Hope Ltd

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts