Question: Tutorial - Depreciation of Non Current Asset 1. D. Bell purchased a laptop for RM480. It has an estimated life of 3 years and a

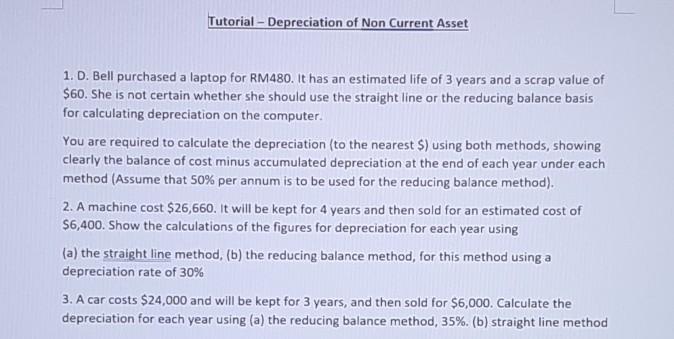

Tutorial - Depreciation of Non Current Asset 1. D. Bell purchased a laptop for RM480. It has an estimated life of 3 years and a scrap value of $60. She is not certain whether she should use the straight line or the reducing balance basis for calculating depreciation on the computer. You are required to calculate the depreciation (to the nearest $) using both methods, showing clearly the balance of cost minus accumulated depreciation at the end of each year under each method (Assume that 50% per annum is to be used for the reducing balance method). 2. A machine cost $26,660. It will be kept for 4 years and then sold for an estimated cost of $6,400. Show the calculations of the figures for depreciation for each year using (a) the straight line method, (b) the reducing balance method, for this method using a depreciation rate of 30% 3. A car costs $24,000 and will be kept for 3 years, and then sold for $6,000. Calculate the depreciation for each year using (a) the reducing balance method, 35%. (b) straight line method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts