Question: Tutorial homework losted below. Please do Risk Apetite and remember to link back to Value. The aim of this tutorial is to provide you with

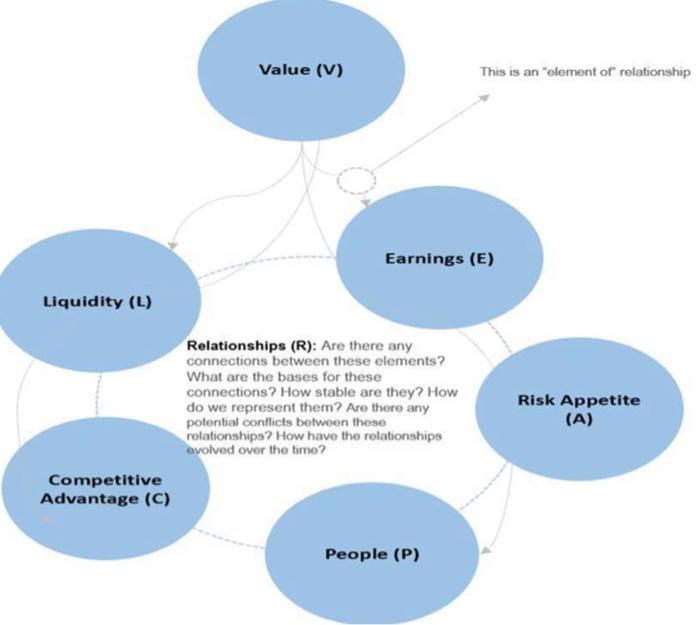

The aim of this tutorial is to provide you with a starting point to address Case 2, and an opportunity for you to consider the issues you think are important given the context of the case. You will do this by presenting a mind map that illustrates your thought processes. You will also receive critical feedback from your colleagues and your tutor about your thought processes and other issues worth considering. Similar to Case 1 , there are already some questions on Blackboard. You are more than welcome to present these in lieu of the mind map. For your mind map, I want you to put yourself into the shoes of the clients (Blackrock Global Impact Fund, and American Funds Capital Income Builder Fund) in the current climate. What would you be looking for in a company in the current economic environment, and why? Make sure when you're explaining why, you link the discussion back to "value" and BHP. Here is a useful framework for you to use, but you aren't limited to these factors. Another hint: you will find most of the discussion/questions from Case 1 relevant here. This is an "element of relationship Liquidity (L) Relationships (R): Are there any connections between these elements? What are the bases for these connections? How stable are they? How do we represent them? Are there any Risk Appetite potential conflicts between these (A) rolationships? How have the relationships ovolved over the time? Competitive Advantage (C) People (P) The aim of this tutorial is to provide you with a starting point to address Case 2, and an opportunity for you to consider the issues you think are important given the context of the case. You will do this by presenting a mind map that illustrates your thought processes. You will also receive critical feedback from your colleagues and your tutor about your thought processes and other issues worth considering. Similar to Case 1 , there are already some questions on Blackboard. You are more than welcome to present these in lieu of the mind map. For your mind map, I want you to put yourself into the shoes of the clients (Blackrock Global Impact Fund, and American Funds Capital Income Builder Fund) in the current climate. What would you be looking for in a company in the current economic environment, and why? Make sure when you're explaining why, you link the discussion back to "value" and BHP. Here is a useful framework for you to use, but you aren't limited to these factors. Another hint: you will find most of the discussion/questions from Case 1 relevant here. This is an "element of relationship Liquidity (L) Relationships (R): Are there any connections between these elements? What are the bases for these connections? How stable are they? How do we represent them? Are there any Risk Appetite potential conflicts between these (A) rolationships? How have the relationships ovolved over the time? Competitive Advantage (C) People (P)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts