Question: Tutorial Q 4 For this question you are required to use the information from Tutorial Q1, Q2 and Q3: Req uired: Prepare a balance sheet

Tutorial Q 4

For this question you are required to use the information from Tutorial Q1, Q2 and Q3:

Required:

Prepare a balance sheet as at 31st March 2020 for the partnership of Ray, Sally and Trent:

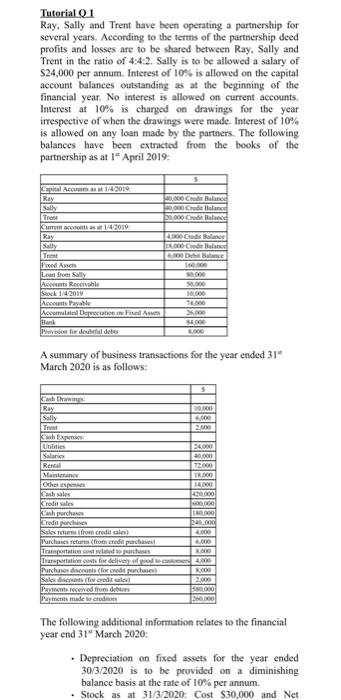

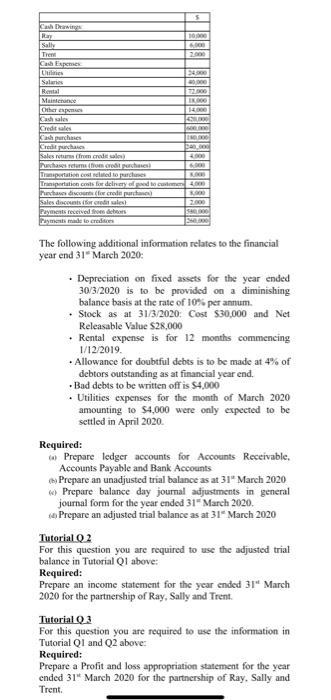

Tutorial 1 Ray, Sally and Trent have been operating a partnership for several years. According to the terms of the partnership deed profits and losses are to be shared between Ray. Sally and Trent in the ratio of 4:42. Sally is to be allowed a salary of S24,000 per annum. Interest of 10% is allowed on the capital account balances outstanding as at the beginning of the financial year. No interest is allowed on current accounts. Interest at 10% is charged on drawings for the year irrespective of when the drawings were made. Interest of 10% is allowed on any loan made by the partners. The following balances have been extracted from the books of the partnership as at 1" April 2019: Capital Ac3010 Ray Sally Tron Kon1443019 Ray Sally 90.000 Choir Balance Cobian 000 elan 4900 GB Balans C D 600 Fixed Ant Loan really Acos Receivable Sock 1/4 2019 Acts Payable Accumulate Depreciation Fund Auct Hank Photos fordul de SEO A summary of business transactions for the year ended 31* March 2020 is as follows: TOO 00 2.000 000 77000 TR 14 Cash Erwin Ray Sally Tres Cash Untities Salari Real Maine Other up Kash sales Krediales Kahpurchase Credits Sales returns (from credit cales) Purchais cars from credit purchase Transportation Transportation is for delivery of produce Purchases (for medias Sales ascents for credits Payments moved from da Payments made to creditan MO 000 000 2.000 BO The following additional information relates to the financial year end 31 March 2020: Depreciation on fixed assets for the year ended 30/3/2020 is to be provided on a diminishing balance basis at the rate of 10% per annum. Stock as at 31/3/2020: Cost $30,000 and Net 10 2000 I! Sally Tren Casa Llities Sales Rental Maintenance Others 100 Kredits Kashurches radica Sales returns (from cada Purchases returns to creat paris Transportation coded to pure Transportation cols fordelnyedo.com Panchas discount for credit portal Sales docents for sale! Payments received from her ayments made to credit SREDO The following additional information relates to the financial year end 31 March 2020: Depreciation on fixed assets for the year ended 30/3/2020 is to be provided on a diminishing balance basis at the rate of 10% per annum Stock as at 31/3/2020: Cost $30,000 and Net Releasable Value $28,000 Rental expense is for 12 months commencing 1/12/2019 Allowance for doubtful debts is to be made at 4% of debtors outstanding as at financial year end. . Bad debts to be written off is $4,000 Utilities expenses for the month of March 2020 amounting to $4,000 were only expected to be settled in April 2020 Required: Prepare ledger accounts for Accounts Receivable, Accounts Payable and Bank Accounts Prepare an unadjusted trial balance as at 31 March 2020 Prepare balance day journal adjustments in general journal form for the year ended 31" March 2020, Prepare an adjusted trial balance as at 31 March 2020 Tutorial Q2 For this question you are required to use the adjusted trial balance in Tutorial Q1 above: Required: Prepare an income statement for the year ended 31 March 2020 for the partnership of Ray, Sally and Trent. Tutorial 03 For this question you are required to use the information in Tutorial Q1 and Q2 above Required: Prepare a Profit and loss appropriation statement for the year ended 31 March 2020 for the partnership of Ray, Sally and Trent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts