Question: Tutorial Questions for Topic 2 Q1: Accounting for bonds At the very beginning of 2008, Heatseaker Ltd issued 200, $1,000 bonds with a coupon rate

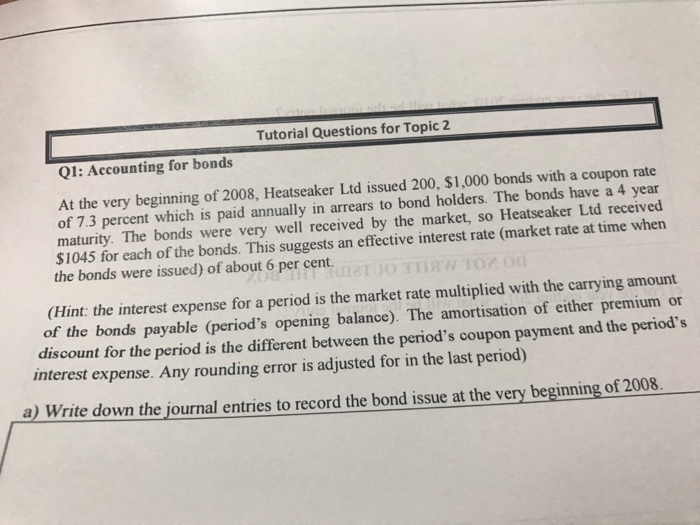

Tutorial Questions for Topic 2 Q1: Accounting for bonds At the very beginning of 2008, Heatseaker Ltd issued 200, $1,000 bonds with a coupon rate of 7.3 percent which is paid annually in arrears to bond holders. The bonds have a 4 year maturity. The bonds were very well received by the market, so Heatseaker Ltd received $1045 for each of the bonds. This suggests an effective interest rate (market rate at time when Hint: the interest expense for a period is the market rate multiplied with the carrying amount of the bonds payable (period's opening balance). The amortisation of either premium or discount for the period is the different between the period's coupon payment and the period' s interest expense. Any rounding error is adjusted for in the last period) a) Write down the journal entries to record the bond issue at the very beginning of 2008

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts