Question: Tuue Video Excel Online Structured Activity: Binomial Model The current price of a stock is $19. In 1 year, the price will be either $26

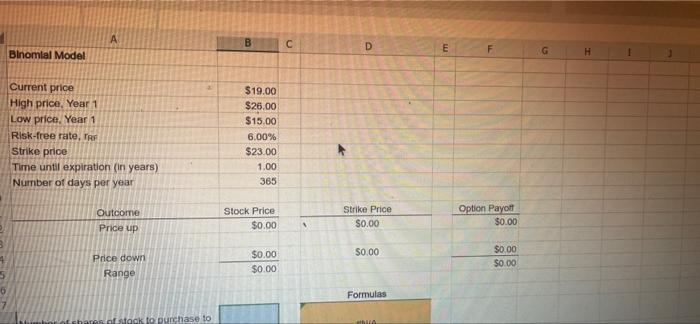

Tuue Video Excel Online Structured Activity: Binomial Model The current price of a stock is $19. In 1 year, the price will be either $26 or $15. The annual risk-free rate is 6%. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. X THE Open spreadsheet Find the price of a call option on the stock that has a strike price is of $23 and that expires in 1 year. (Hint: Use daily compounding.) Assume 365-day year. Do not round intermediate calculations. Round your answer to the nearest cent. Check My Work Reset Problem B D E Binomial Model G H Current price High price, Year 1 Low price. Year 1 Risk-free rate, TRF Strike price Time until expiration (in years) Number of days per year $19.00 $25.00 $15.00 6.00% $23.00 1.00 365 Outcome Price up Stock Price $0.00 Strike Price $0.00 Option Payot $0.00 $0.00 Price down Range $0.00 $0.00 $0.00 $0.00 5 Formulas Neak to purchase to

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts