Question: TVM Problem Part A (13 points) Katie wants to have the equivalent of $65,000 per year (in today's dollars) for living expenses during her retirement

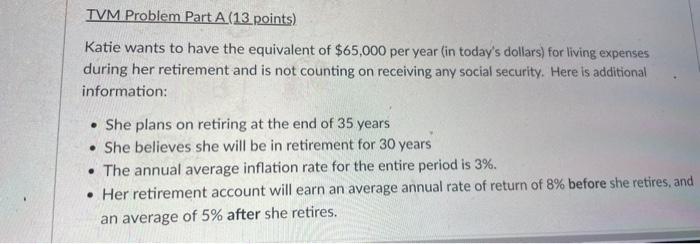

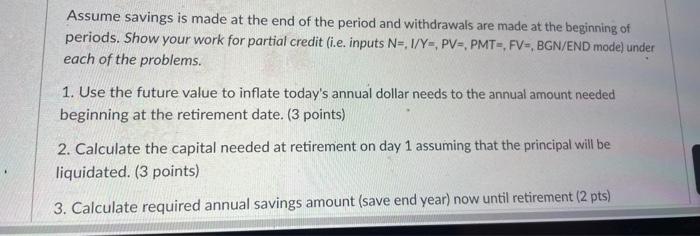

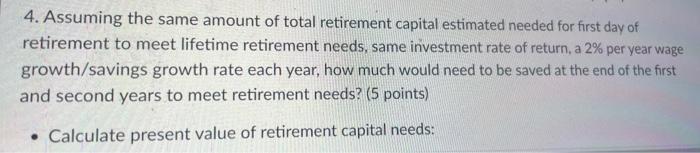

TVM Problem Part A (13 points) Katie wants to have the equivalent of $65,000 per year (in today's dollars) for living expenses during her retirement and is not counting on receiving any social security. Here is additional information: - She plans on retiring at the end of 35 years - She believes she will be in retirement for 30 years - The annual average inflation rate for the entire period is 3%. - Her retirement account will earn an average annual rate of return of 8% before she retires, an an average of 5% after she retires. Assume savings is made at the end of the period and withdrawals are made at the beginning of periods. Show your work for partial credit (i.e. inputs N=I/Y=,PV=,PMT=,FV=,BGN/END mode) under each of the problems. 1. Use the future value to inflate today's annual dollar needs to the annual amount needed beginning at the retirement date. ( 3 points) 2. Calculate the capital needed at retirement on day 1 assuming that the principal will be liquidated. (3 points) 4. Assuming the same amount of total retirement capital estimated needed for first day of retirement to meet lifetime retirement needs, same investment rate of return, a 2% per year wage growth/savings growth rate each year, how much would need to be saved at the end of the first and second years to meet retirement needs? ( 5 points) - Calculate present value of retirement capital needs: - Calculate present value of retirement capital needs: Annual savings amount 1st&2nd years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts