Question: Twelve years ago, Mr . Davis contributed a property that includes a building and land to Davis Office Furniture, a C corporation. The property will

Twelve years ago, Mr Davis contributed a property that includes a building and land to Davis Office Furniture, a C corporation.

The property will be used for office and warehouse space.

Mr Davis acquired the property and used it as rental property for five years prior to the contribution to the corporation.

The property was exchanged for a percent equity interest in the corporation.

After the contribution of the property, Mr Davis had an interest in the corporation.

The adjusted tax basis in the warehouse property at the time of the contribution to the corporation was $building $ and $ land This basis reflects depreciation taken up to the date of the contribution.

The buildings appraised FMV on date of contribution to the business was $

During the current year, Mr Davis decided to retire and close the business.

On the last day of the year the corporation sold the property building and land to an unrelated purchaser for $

A realtor was paid a percent commission.

The corporation will liquidate its office furniture inventory shortly and the company may need your assistance with that at a later date.

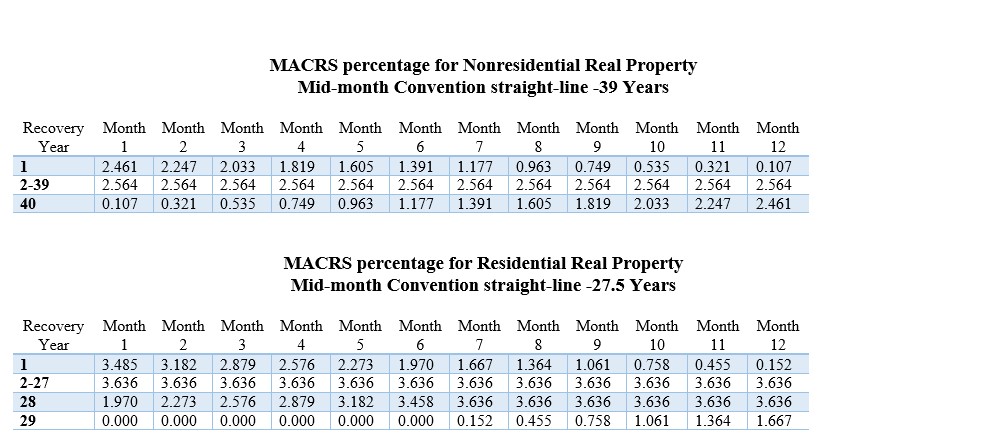

Considering that the property is depreciable, determine its adjusted basis on the date of sale. Assume that the contribution of the property to the corporation was made on the first day of the year and the corporations sale of the property was made on the last day of the year twelve years later Be mindful that the midmonth convention is built in the MACRS table for the year of acquisition but not in the year of the disposition sale

I calculated adjusted basis, but I am not sure if I am correct:

Here is my calculation:

Yearly Depreciation for the Structure:

Initial construction cost: $

Duration of recovery: years

We compute the yearly depreciation by dividing $ by which results in a rounded figure of $

Total Depreciation Across a Year Period

Total depreciation equals $ multiplied by resulting in $

Revised based on sale date:

The adjusted basis of the building is $

The adjusted basis for the land is $ as it is not subject to depreciation.

The total adjusted basis including building and land on the date of sale is:

Could you please review my answer if it is correct calculation. Thank you

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock