Question: Twilite Ltd is preparing its budget for the next 3 months - June, July and August. Budgeted sales are as follows: 14,000 units 14,500

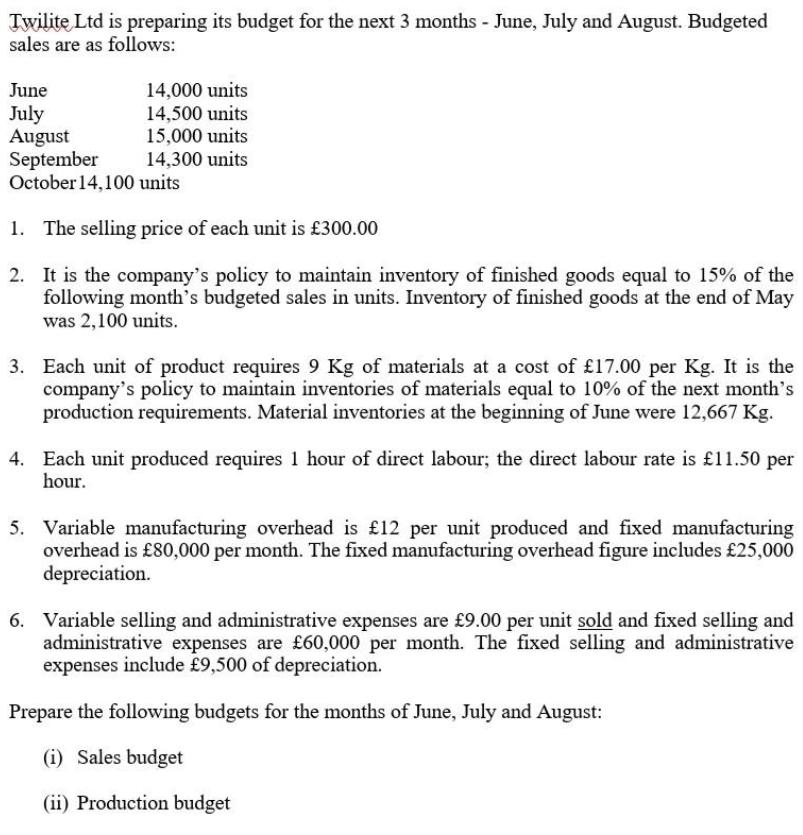

Twilite Ltd is preparing its budget for the next 3 months - June, July and August. Budgeted sales are as follows: 14,000 units 14,500 units 15,000 units 14,300 units June July August September October14,100 units 1. The selling price of each unit is 300.00 2. It is the company's policy to maintain inventory of finished goods equal to 15% of the following month's budgeted sales in units. Inventory of finished goods at the end of May was 2,100 units. 3. Each unit of product requires 9 Kg of materials at a cost of 17.00 per Kg. It is the company's policy to maintain inventories of materials equal to 10% of the next month's production requirements. Material inventories at the beginning of June were 12,667 Kg. 4. Each unit produced requires 1 hour of direct labour; the direct labour rate is 11.50 per hour. 5. Variable manufacturing overhead is 12 per unit produced and fixed manufacturing overhead is 80,000 per month. The fixed manufacturing overhead figure includes 25,000 depreciation. 6. Variable selling and administrative expenses are 9.00 per unit sold and fixed selling and administrative expenses are 60,000 per month. The fixed selling and administrative expenses include 9,500 of depreciation. Prepare the following budgets for the months of June, July and August: (i) Sales budget (ii) Production budget 2 marks (iii) Direct materials purchases budget 3 marks (iv) Direct labour budget 2 marks (v) Production overhead budget 2 marks (vi) Selling and admin overhead budget 2 marks (vii) Discuss the validity of the criticisms of traditional budgeting that have been advanced by the Beyond Budgeting Round Table.

Step by Step Solution

There are 3 Steps involved in it

Sales Budget June July August Sales in units 14000 14500 15000 Selling price per unit 300 300 3000 S... View full answer

Get step-by-step solutions from verified subject matter experts