Question: Twinkle and Shine Sdn Bhd ( TS ) is a manufacturer of cosmetic products registered under Sales Tax Act 2 0 1 8 on 1

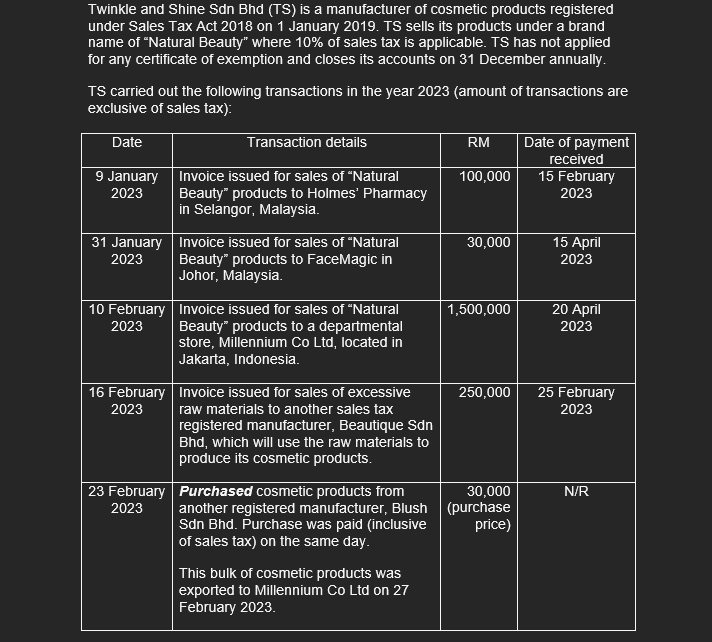

Twinkle and Shine Sdn Bhd TS is a manufacturer of cosmetic products registered under Sales Tax Act on January TS sells its products under a brand name of "Natural Beauty" where of sales tax is applicable. TS has not applied for any certificate of exemption and closes its accounts on December annually.

TS carried out the following transactions in the year amount of transactions are exclusive of sales tax

Required:

a

Provide explanation to the following questions;

iHow would the taxable period of TS be determined?

iiWhat is the due date for payment of sales tax for the sales made to Holmes Pharmacy and FaceMagic? Please provide further explanation whether the due date is affected by the date of payment received

iiiWhat should be the tax treatment for the sales made to Millennium Co Ltd

ivSuggest and explain a facility in Sales Tax Act that is available to Beautique Sdn Bhd to minimise its sales tax liability in relation to the purchase of raw materials on February

vSuggest and explain a facility in Sales Tax Act that is available to TS to reduce its sales tax burden in relation to the export of cosmetic products on February Please explain the necessary steps of the application.

bBased on your explanation in a above, compute the sales tax payable by TS

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock