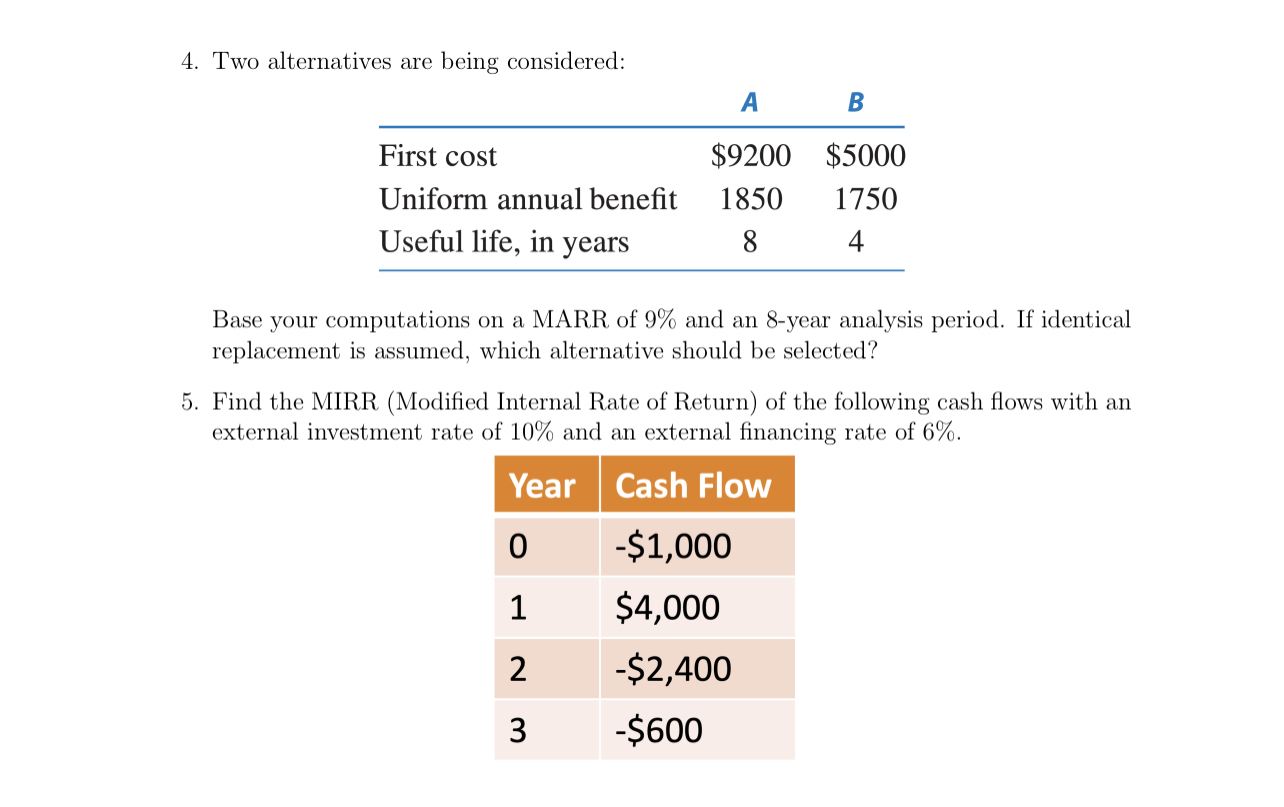

Question: Two alternatives are being considered: Base your computations on a MARR of 9 % and an 8 - year analysis period. If identical replacement is

Two alternatives are being considered:

Base your computations on a MARR of and an year analysis period. If identical

replacement is assumed, which alternative should be selected?

Find the MIRR Modified Internal Rate of Return of the following cash flows with an

external investment rate of and an external financing rate of

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock