Question: Two basic types of retirement programs-Keogh and SEP (for self-employed individuals)-and IRAs allow individuals to set up their own tax-sheltered retirement plans. If you

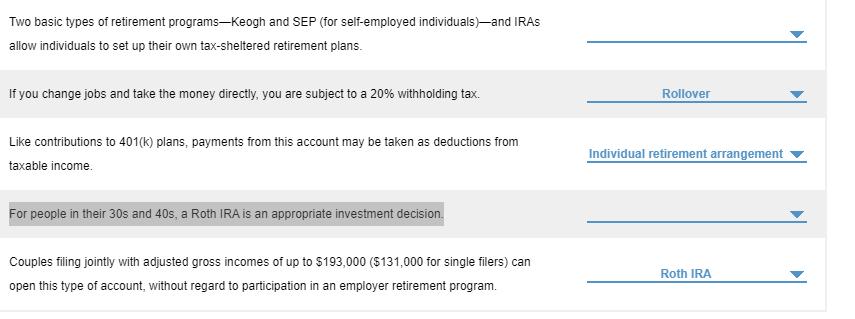

Two basic types of retirement programs-Keogh and SEP (for self-employed individuals)-and IRAs allow individuals to set up their own tax-sheltered retirement plans. If you change jobs and take the money directly, you are subject to a 20% withholding tax. Rollover Like contributions to 401(k) plans, payments from this account may be taken as deductions from taxable income. Individual retirement arrangement For people in their 30s and 40s, a Roth IRA is an appropriate investment decision. Couples filing jointly with adjusted gross incomes of up to $193,000 ($131,000 for single filers) can open this type of account, without regard to participation in an employer retirement program. Roth IRA

Step by Step Solution

There are 3 Steps involved in it

A Roth IRA is an individual retirement arrangement that allows individuals to set up their own taxsh... View full answer

Get step-by-step solutions from verified subject matter experts