Question: Two basic ways capital is raised by firms is through debt, e.g., bonds and notes, and equity (stock sales). Interest must be paid for debt

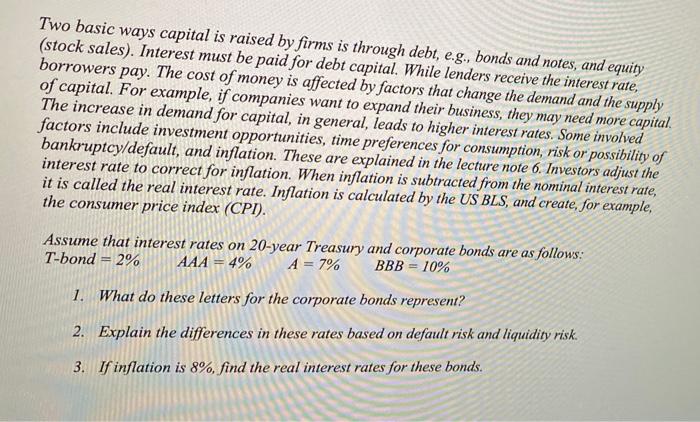

Two basic ways capital is raised by firms is through debt, e.g., bonds and notes, and equity (stock sales). Interest must be paid for debt capital. While lenders receive the interest rate, borrowers pay. The cost of money is affected by factors that change the demand and the supply of capital. For example, if companies want to expand their business, they may need more capital The increase in demand for capital, in general, leads to higher interest rates. Some involved factors include investment opportunities, time preferences for consumption, risk or possibility of bankruptcy/default, and inflation. These are explained in the lecture note 6. Investors adjust the interest rate to correct for inflation. When inflation is subtracted from the nominal interest rate, it is called the real interest rate. Inflation is calculated by the US BLS, and create, for example, the consumer price index (CPI). Assume that interest rates on 20-year Treasury and corporate bonds are as follows: T-bond = 2% AAA = 4% A = 7% BBB = 10% 1. What do these letters for the corporate bonds represent? 2. Explain the differences in these rates based on default risk and liquidity risk. 3. If inflation is 8%, find the real interest rates for these bonds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts