Question: Two companies ABC and BDA each have expected dividends per share with a constant growth rate for the foreseeable future. Why would ABC's stock have

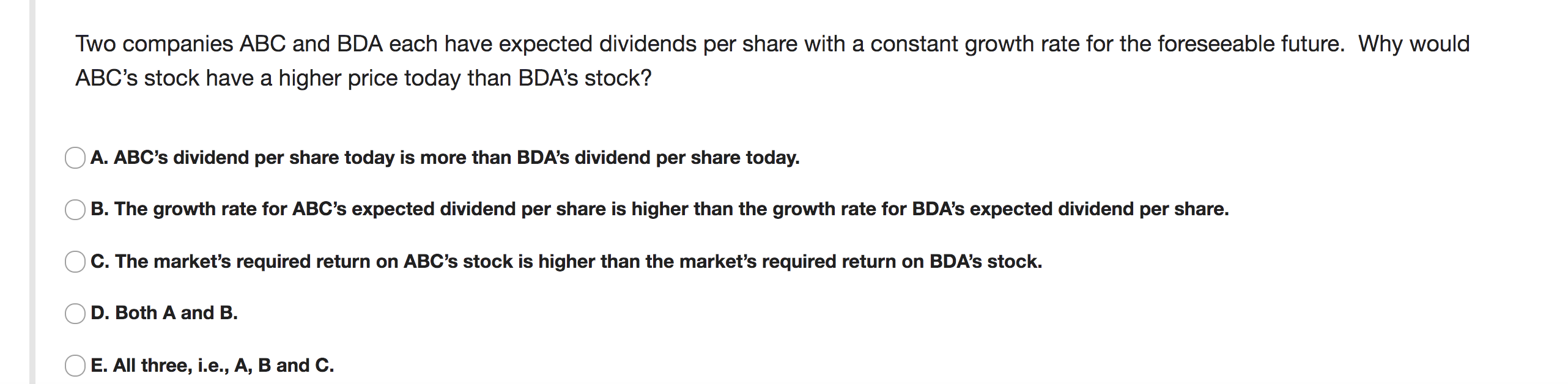

Two companies ABC and BDA each have expected dividends per share with a constant growth rate for the foreseeable future. Why would ABC's stock have a higher price today than BDA's stock? OA. ABC's dividend per share today is more than BDA's dividend per share today. OB. The growth rate for ABC's expected dividend per share is higher than the growth rate for BDA's expected dividend per share. C. The market's required return on ABC's stock is higher than the market's required return on BDA's stock. D. Both A and B. O E. All three, i.e., A, B and C

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock