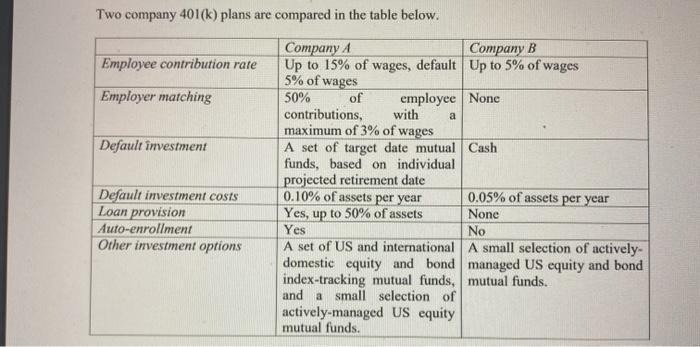

Question: Two company 401(k) plans are compared in the table below. Company A Up to 15% of wages, default 5% of wages 50% of Employee

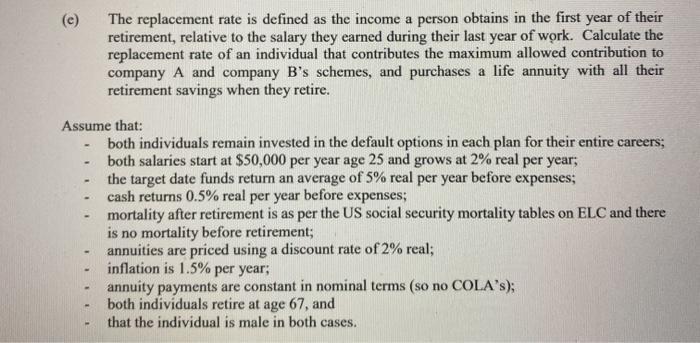

Two company 401(k) plans are compared in the table below. Company A Up to 15% of wages, default 5% of wages 50% of Employee contribution rate Employer matching Default nvestment Default investment costs Loan provision Auto-enrollment Other investment options employee None contributions, with maximum of 3% of wages A set of target date mutual Cash funds, based on individual projected retirement date 0.10% of assets per year Yes, up to 50% of assets Yes a Company B Up to 5% of wages A set of US and international domestic equity and bond index-tracking mutual funds, and a small selection of actively-managed US equity mutual funds. 0.05% of assets per year None No A small selection of actively- managed US equity and bond mutual funds. (c) Assume that: both individuals remain invested in the default options in each plan for their entire careers; both salaries start at $50,000 per year age 25 and grows at 2% real per year; the target date funds return an average of 5% real per year before expenses; cash returns 0.5% real per year before expenses; mortality after retirement is as per the US social security mortality tables on ELC and there is no mortality before retirement; - - - The replacement rate is defined as the income a person obtains in the first year of their retirement, relative to the salary they earned during their last year of work. Calculate the replacement rate of an individual that contributes the maximum allowed contribution to company A and company B's schemes, and purchases a life annuity with all their retirement savings when they retire. - annuities are priced using a discount rate of 2% real; inflation is 1.5% per year; annuity payments are constant in nominal terms (so no COLA's); both individuals retire at age 67, and that the individual is male in both cases.

Step by Step Solution

3.32 Rating (149 Votes )

There are 3 Steps involved in it

To calculate the replacement rate for an individual who contributes the maximum allowed contribution to the 401k plans of Company A and Company B and ... View full answer

Get step-by-step solutions from verified subject matter experts