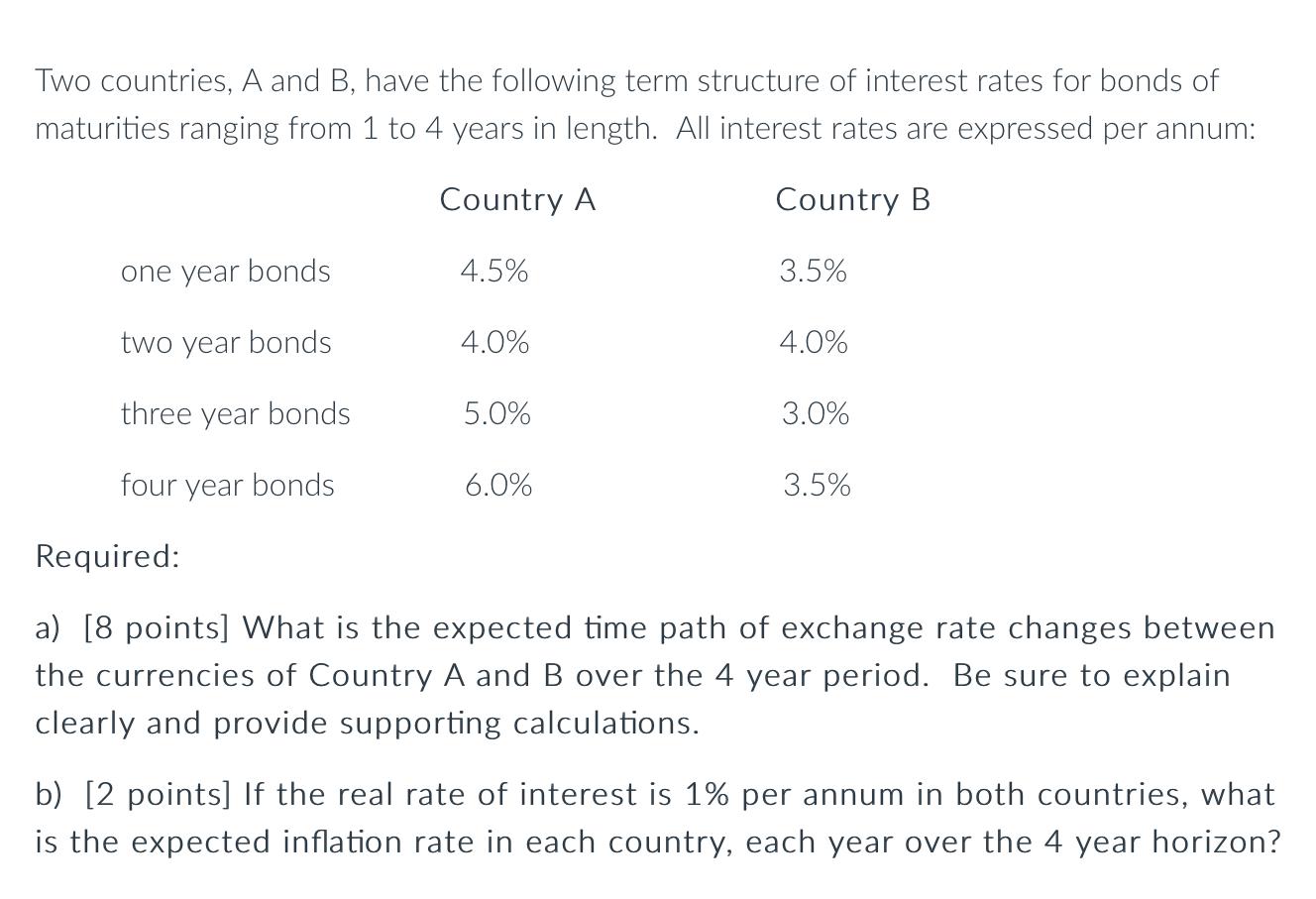

Question: Two countries, A and B, have the following term structure of interest rates for bonds of maturities ranging from 1 to 4 years in

Two countries, A and B, have the following term structure of interest rates for bonds of maturities ranging from 1 to 4 years in length. All interest rates are expressed per annum: Country A Country B 4.5% one year bonds two year bonds three year bonds four year bonds 4.0% 5.0% 6.0% 3.5% 4.0% 3.0% 3.5% Required: a) [8 points] What is the expected time path of exchange rate changes between the currencies of Country A and B over the 4 year period. Be sure to explain clearly and provide supporting calculations. b) [2 points] If the real rate of interest is 1% per annum in both countries, what is the expected inflation rate in each country, each year over the 4 year horizon?

Step by Step Solution

3.27 Rating (147 Votes )

There are 3 Steps involved in it

a 8 points What is the expected time path of exchange rate changes between the currencies of Country A and B over the 4 year period Be sure to explain ... View full answer

Get step-by-step solutions from verified subject matter experts