Question: Two countries initially prohibit international capital flows and have different interest rates in autraky. If they agree to remove all restrictions on capital flows between

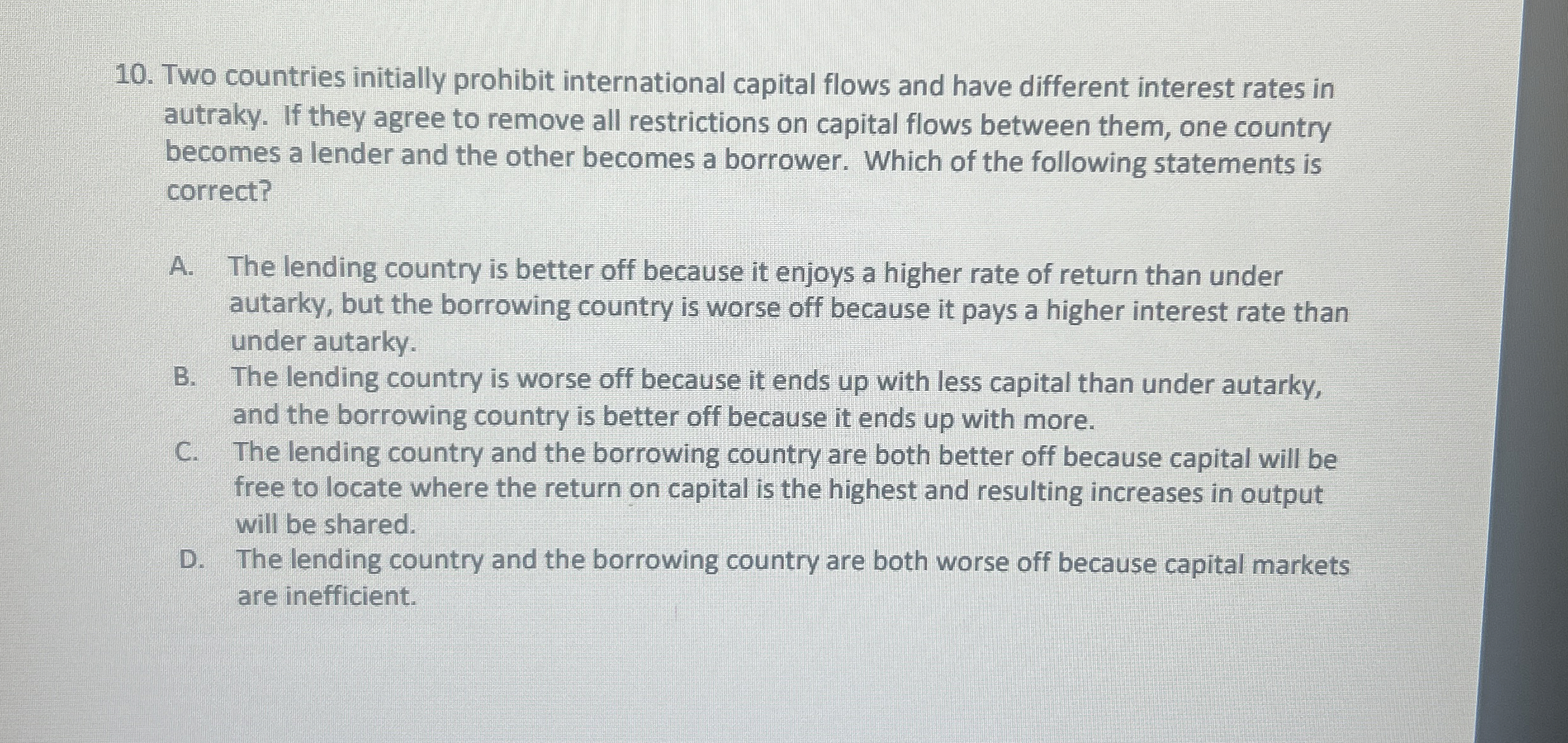

Two countries initially prohibit international capital flows and have different interest rates in autraky. If they agree to remove all restrictions on capital flows between them, one country becomes a lender and the other becomes a borrower. Which of the following statements is correct?

A The lending country is better off because it enjoys a higher rate of return than under autarky, but the borrowing country is worse off because it pays a higher interest rate than under autarky.

B The lending country is worse off because it ends up with less capital than under autarky, and the borrowing country is better off because it ends up with more.

C The lending country and the borrowing country are both better off because capital will be free to locate where the return on capital is the highest and resulting increases in output will be shared.

D The lending country and the borrowing country are both worse off because capital markets are inefficient.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock