Question: Two different machines are under consideration for an engineering project. Machine X is expected to have an initial cost of $74,000 and an expected life

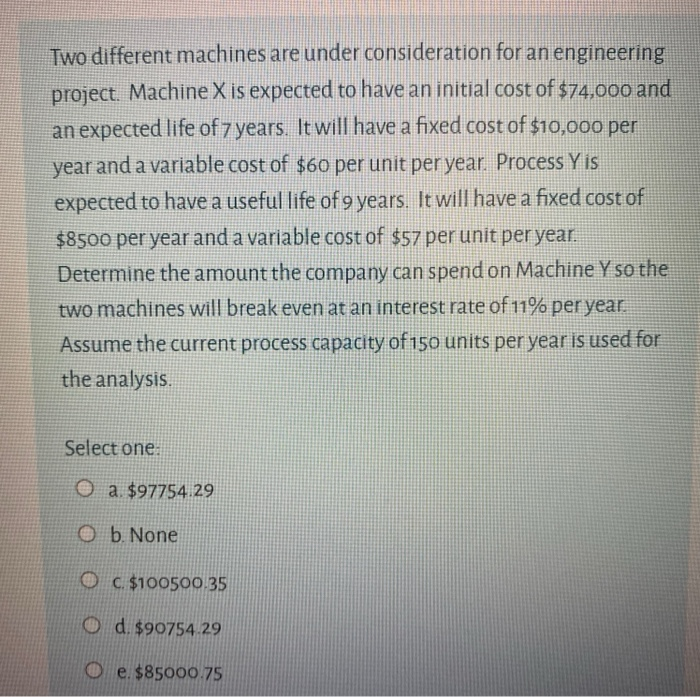

Two different machines are under consideration for an engineering project. Machine X is expected to have an initial cost of $74,000 and an expected life of 7 years. It will have a fixed cost of $10,000 per year and a variable cost of $60 per unit per year. Process Y is expected to have a useful life of 9 years. It will have a fixed cost of $8500 per year and a variable cost of $57 per unit per year. Determine the amount the company can spend on Machine Y so the two machines will break even at an interest rate of 11% per year. Assume the current process capacity of 150 units per year is used for the analysis Select one a. $97754.29 O b. None C. $100500.35 d. $90754.29 e. $85000.75

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts